Second post: Masco Inc

A "boring" high returns business trading on highly attractive multiples

Disclosures

I and/or others I advise hold a material investment in Masco. Everything expressed here is only my own opinion, it should not be relied upon, nor should be considered investment advice. Always do your own independent research.

Background

Masco ($12bn market cap) is a US based manufacturer and distributor of branded home improvement and plumbing fixtures, primarily faucets and paint, focused on the repair and remodel segment of the housing industry.

During the US housing crisis of 2008/09, Masco suffered greatly due to excessive debt and exposure to new construction; post the crisis, a new management team transformed the company into a less volatile and higher returns business, shedding its most cyclical assets and focusing on its two higher returns and more stable plumbing and decorative paint businesses.

The company today sells primarily low-ticket items that are defensive in a residential housing downturn, enjoy strong pricing power, earn high returns (18-19% EBIT margin) with low capital intensity (2.5% capex/sales); overall group EPS should grow by +10% p.a on average whilst paying a dividend yield of 2%.

Summary Investment Thesis

Transformed company post GFC: since 2013 Masco started a process of overhaul of its portfolio, improving its returns and stability profile by divesting its more cyclical and lower margins businesses (Insulation installer, Cabinetry and Windows) whilst retaining its higher returns and more stable Paint and Plumbing businesses. The company also tilted its exposure towards the repair & remodel markets (90% of group) and reduced its new construction exposure to only 10% of the group.

Paint and Plumbing are “boring” but high-quality businesses: both paint and plumbing own strong brands, sell low ticket items, have leading distribution capabilities and generate high margins (18%+) with limited capital intensity (capex/sales 2.5%); furthermore, they benefit from secular tailwinds such as aging of the housing stock and demand for smart and energy efficient home products.

Savvy capital allocation: on top of improving the company’s business portfolio, management has repurchased 25% of outstanding shares in the last 5 years; management’s long-term incentives scheme is tied to increasing 3-years group ROIC, which impressively averaged 17% in the last 3-years.

Solid financial algorithm: the business should grow topline between +4-8% p.a. broken down as +3-5% organic and +1-3% bolt on acquisitions; overall EPS should compound at around +10% driven by an additional +2-4% of annual buybacks; capital intensity is low (2-2.5% capex/sales) and returns on capital are high (CFROI is >20%).

Attractively valued: Masco performed similarly to more cyclical housing exposed names despite its higher exposure to repair and remodel end markets (c.90% of revenues); it trades on 14x P/E and a FCF yield of 7.0% whilst FCF/share growth is >10% p.a and returns on capital are double digits.

Key Attractions

Defensive, low-ticket items manufacturer with strong owned brands, exposed to the relatively a-cyclical US repair & remodel market.

Persistently generated high returns on capital (ROIC >30% and CFROI>20%), with low financial leverage (1.8x).

Strong pricing power (+9% pricing in FY22) and strong brands (Behr, Delta).

Attractively valued as still perceived as highly cyclical, despite much improved returns and stability profile (trades on >7% FCF yield, >2% dividend yield).

Management with a track record of excellent capital allocation in the last 9 years.

Only 4 CEOs in the company’s nearly 100 years history.

Key Risks

Customer concentration: the Home Depot is the company’s largest customer, accounting for 36% of sales, through its exclusive distribution in the US of Masco’s paint Brand Behr. Ferguson and Lowe’s account each for less than 10% of group sales.

Mitigants: The Behr-Home Depot relationship on decorative paint has been enduring for 40 years and is symbiotic: HD benefits from the exclusivity of a popular high performing brand to drive store traffic, whilst Behr benefits from HD’s world class distribution network. The two companies’ factories, supply chain and salesforces are deeply interconnected (more details on this in the main body of the write up below).

Raw material inflation: like other coatings company, Masco is exposed – in the short term – to volatility in raw-material prices, particularly oil derivatives and TiO2.

Mitigants: Over the mid-term, Masco’s strong pricing power allows it to recoup cost inflation and restore its high teens EBIT margin.

Cyclicality: the company is still exposed to the housing cycle, particularly in the US (80% of sales).

Mitigants: importantly, the company is heavily exposed to the more stable repair and remodel end markets than in the past.

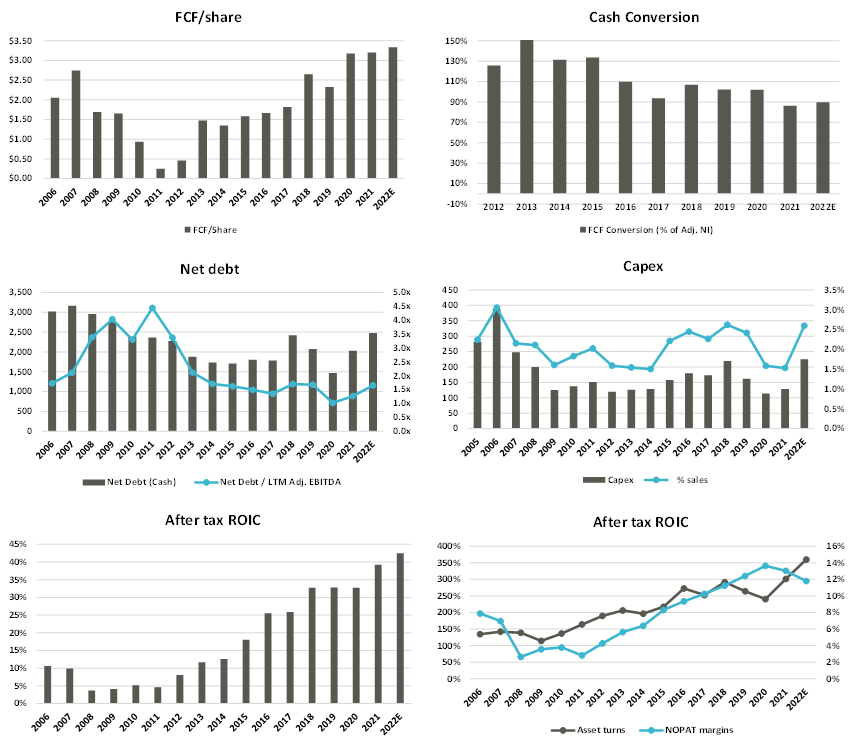

Investment Thesis in Charts

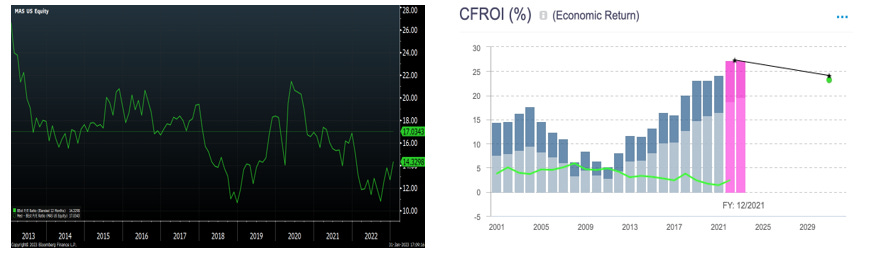

Group returns/CFROI improved since 2014 through divestments and focus on higher margins Plumbing and Decorative Architectural businesses.

The group is more resilient than in the past, with 90% exposure to repair & remodelling and a focus on low-ticket items.

The stock still trades on an undemanding P/E, despite a much-improved returns profile and greater stability.

Structure of this Write-up:

Brief History

Key Exposures

Industry Context

Business Model

Relationship with The Home Depot

Management & Remuneration

Historic Financials

Financial Algorithm

Capital Allocation

Historic TSR

Why the Opportunity Exists

Valuation

Brief History

The company was founded in 1929 by Alex Manoogian, the inventor of the world’s first single handle hot/cold faucet; the business was listed in 1936, as Masco Screw Product Company, selling parts to the automotive industry. Only in 1952 the business started to operate in the plumbing industry, as the founder designed the first single-handle hot/cold faucet, now known as Delta.

During the period 1996-2002, Richard Manoogian, son of founder Alex, went on an acquisition spree, over-stretching the business both financially and operationally.

As a consequence, during the Great Financial Crisis (2007-2009) the company greatly suffered and the stock collapsed.

From 2014, a new management team was put in place to overhaul and restructure the business, shedding the more cyclical and low margins part of the portfolio:

In 2015, the company spun out Topbuild, a cyclical installer and distributor of insulation products (now listed under the ticker BLD US).

In 2019-20, the lower margin windows and cabinetry businesses were divested respectively for $725mn (to MI Windows and Doors in Oct-19) and $1bn (to ACProducts Inc, in 2020).

The benefits of the restructuring process post the 2008/09 recession are well visible in the CS HOLT chart below, breaking down the evolution of Economic Profit by segment over time.

As of today the company is focused on two high margin, resilient businesses: Plumbing Products (60% of EBIT, 18% margin) and Decorative Architectural Products 40% of group EBIT, 19% margin).

Importantly, note that even at the depth of the financial crisis of 2008/09, both Paint and Plumbing operating margins remained positive (around 10%), whereas Cabinets and Windows fell into a large loss (-35% margins).

Key Exposures

Masco reports across two divisions, Decorative Architectural (or paint) and Plumbing; the former is slightly more profitable than the latter, but both earn attractive margins, well in the high-teens.

Masco today is primarily a North American business (c.80% of sales), exposed to the repair and remodelling end markets (c.90% of group), whilst new construction is of limited importance (only 10% of the group).

The company operates 30 manufacturing sites in the US and 10 overseas, the latter exclusively for the plumbing business. Most of the international facilities are located in China, Germany and the UK.

Industry Context

From a macro standpoint, most US housing exposed stocks have suffered a significant derating since the Fed started to raise rates meaningfully and US mortgage rates spiked.

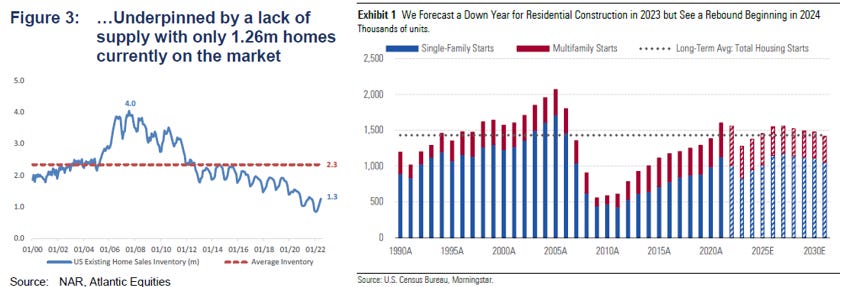

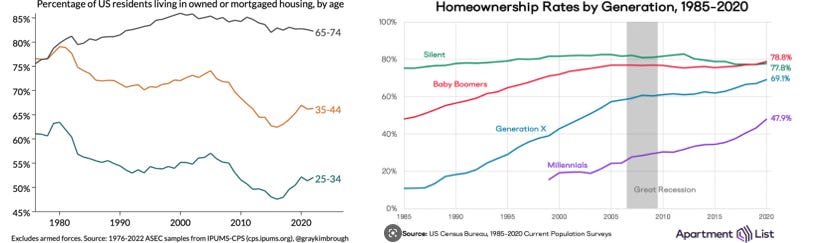

It is though important to bear in mind that new construction accounts for only 10% of Masco’s revenue; c.90% of the group today is exposed to the more resilient Repair & Remodel end market, which is underpinned by several secular tailwinds such as (a) ageing housing stock, (b) favourable demographic, and (c) increase demand for energy efficient homes.

Long-term fundamentals remain supportive for US housing, underpinned by strong household formation and limited supply of housing in the recovery post the Great Financial Recession.

In particular, it is interesting to note that 90mn-person millennial generation is engaging finally with housing in the last couple of years.

Since many US households have locked-in mortgage rates significantly below the current level in the financing market, housing turnover and transactions have fallen significantly in the last few months; on the other hand, interestingly for Masco, many homeowners are “trapped” in their existing homes and more likely to invest in their main asset (via repair/remodel), as opposed to buying a new build in future years.

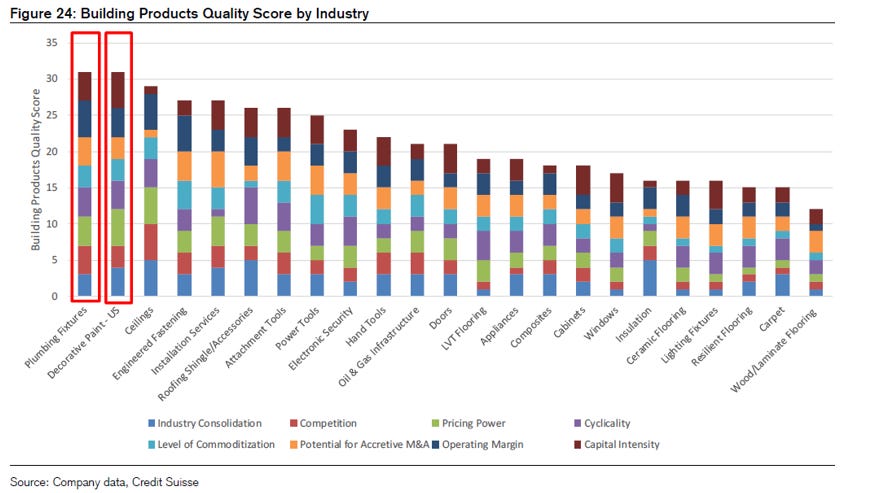

Masco today operates in two of the highest quality sub-segments within the Building Products space – namely Paint and Plumbing – if we are to consider they operate in (i) highly consolidated markets, (ii) have strong pricing power (pricing in 2022 was +9%), (iii) require little capital to grow, (iv) are less cyclical and (v) have a low level of commoditization (see the ranking chart below from Credit Suisse, where 5 is the highest score, and 1 the lowest).

Within the plumbing segment, Masco is the largest manufacturer of plumbing fixtures in the world. The company specializes in faucets and shower heads, where the top three players control 75% of the market: Masco’s leading brand Delta controls 25% share, and is the number 2 player behind Moen (30% share). Private label penetration is stable around 20%, as customers do care about brand and product innovation (for example digital temperature displays on shower fixtures).

Masco’s plumbing division also include the Watkins brand – the world’s largest outdoor spa business (10% of segment sales) – and BrassCraft, which is a manufacturer of brass valves well known by plumbers in the US.

In the Decorative Architectural division, Masco owns the Behr paint brand, which is exclusively distributed by The Home Depot in North America.

The Behr brand serves primarily DIY customers (70% of divisional sales), but experienced strong growth in the last few years in the PRO segment too (30%).

Masco’s closest peer in the paint segment is Sherwin William’s Consumer Brands (CB) business, which supplies Lowe’s and is a low single digit grower with low-teens margin business.

However, I believe Masco’s Paint business is higher quality than Sherwin’s CB business for three reasons: (i) it grows faster thanks to its rapidly growing PRO business at Home Depot, (ii) its margins are in the high-teens, that is +300-500bps higher than Sherwin’s DIY business and (iii) it is less asset intensive, thanks to the Home Depot partnership.

Within the Decorative Architectural segment, Masco also owns two smaller businesses: Liberty Hardware, the leading retail cabinet hardware company in the US and Kichler, amongst the top brands in the lighting industry that serves broad distribution.

Business Model

Masco Plumbing and Decorative Architectural divisions focus on small ticket items sales.

Indeed, both faucets and paint are small purchases that cost on average around hundreds of dollars, compared to cabinet and windows which average in the thousands of dollars; thus Paint and Plumbing sales tend to be less cyclical, and are not usually tied to large remodelling projects: faucets need to be replaced when they break and paint jobs are usually not delayed as they significantly impact the value of a property without requiring a large upfront cash investment.

In terms of customer types, the overall group is equally balanced between DIY and PRO contractors; having said this, the Paint business is more skewed to DIY customers (c.70%) as PRO paint is a nascent category that reached around 30% of total paint sales ($900mn sales business today); the opposite is true of the Plumbing business, which is skewed more towards contractors customers.

Masco goes to market primarily via its retail relationships and through the trade/wholesale channel; eCommerce is a smaller but growing channel, particularly for the plumbing business.

The group hosts a portfolio of brands, the most important being Delta Plumbing and Hansgrohe in the plumbing division and the Behr brand in the Decorative Paint division.

The brands are innovative and well invested: management often points out that circa 30% of group sales come from products introduced in the last 3 years (ie the vitality index score is high).

Delta Plumbing was founded in 1954 and is amongst the strongest faucets and shower-head brand in North America: it manufactures and sells a range of plumbing products to both professional contractors and via the retail channel. Delta’s average price point is slightly below Fortune Brands’s Moen but well above American Standards and other lower end brands. The Hansgrohe brand was founded in 1901 and is headquartered in Germany and it is Masco’s leading overseas brand, available in c.70 countries.

Importantly, in Plumbing, pricing power is strong (pricing in FY22 was +7%), as brand awareness, service and product quality are all important factors in the purchase decision. Furthermore, within Plumbing, Masco generally sells to small customers, such as small wholesaler, showrooms etc. As evidence of this pricing power, one can look at Plumbing margins which tend to expand when brass metal prices fall, and are retained at high level when metal prices fall.

In the Decorative Architectural division, the Behr paint brand is the leading brand and was acquired by Masco in 1999.

The brand controls circa 30% of the DIY coatings market and more recently has made inroads into the PRO market too, through a joint effort with its exclusive distribution partner The Home Depot.

Similar to plumbing, coating businesses enjoy strong pricing power (price >10% in FY2022) as usually paint is a small portion (15%) in the overall cost of a paint job (85% of cost is labour).

Key competitors to Masco are other well established paint manufacturers such as Sherwin Williams, PPG, Benjamin Moore (controlled by Warren Buffet) and RPM International.

Relationship with Home Depot

The Behr and Home Depot (HD) relationship started 40 years ago, it goes all the way back when Home Depot was just starting out in 1978, when there were only two HD stores.

Behr was one of the first suppliers to Home Depot and is exclusively sold in the home improvement retail giant stores. The exclusive partnership allowed Masco to leverage Home Depot’s distribution channel gain market share along with Home Depot’s continued store expansion.

This partnership allowed Masco to allocate more resources into research than sales and marketing, improving the quality of the product, whereas other coatings competitors had to invest also in distribution (store space) and logistics arrangements (whereas Masco partners with HD formidable supply chain).

The Behr brand is deeply ingrained within Home Depot, as their decades-long relationship not only includes shelf space in the stores but also mind share with Behr salesforce located inside the Home Depot stores. Furthermore, Masco’s management makes the point that their own supply chain is deeply aligned with The Home Depot’s even in terms of locating their own factories.

Masco’s Behr brand has effectively become Home Depot’s house paint brand (whereas other competitors brands have channel conflicts, ie other customers and/or their own stores). The Behr brand in 2022 won the Partner of the Year Award for the Home Depot, for the second consecutive year.

Competitors brands sold at the Home Depot are lower quality alternatives to Behr (such as PPG’s Glidden brand); alternatively other competitors are exclusive to Home Depot’s competitor Lowe’s (such as Sherwin’s DIY brands).

Paint is a hugely important category for Home Depot as it drives strong traffic and has a strong attachment rate (ie customers don’t only buy Behr paint, they also buy Home Depot’s high margin accessories such as brushes, tapes, tins, tarps etc).

Home Depot and Masco’s interests are well aligned and this is evident in the success they had with the launch of the PRO paint product, which has been growing double digits for many years and today accounts for 30% of Behr total paint sales; the Behr brand is the perfect partner for Home Depot to gain market share in the PRO segment (ie professional contractors) because Behr does not have a company owned store footprint already catering to it.

To give you an example of how integrated the two companies are, it is helpful to consider how customers can purchase paint samples online: this can be done either through the Behr or Home Depot websites; however what ultimately happens is that the transaction page is actually a single website on the Home Depot site. So even if ordered through the Behr own website, the customer ends up on the transaction page on the Home Depot website, which goes a long way to show how integrated Behr is with the Home Depot on the paint side of the business.

Importantly, the relationship with Home Depot also regulates how profits are shared in period of raw-material inflation: Masco is assured dollar cost recovery, which during period of high inflation translates into margin compression, and conversely during deflationary environments sees margin expansion.

This is best explained via an example: if there’s a 5% price increase in architectural paint, that translates into 100bps of margin dilution, but no impact on dollar profits. This is why we have witnessed margins in percentage terms falling in 2021-22 and expect these to recover going forward as the raw material inflation cycle comes to an end.

Management & Remuneration

Keith J Allman – was named CEO in 2014 and was the driving force behind the overhaul of the business post the Great Financial Recession; he is only the 4th CEO to lead the company since its founding and joined Masco in 1998.

John Sznewajs – was named CFO in 2007 and is poised to retire in May 2023; he joined the company in 1996 and served in a variety of roles in treasury, corporate development and finance. A search for a new CFO is underway.

Management remuneration can be split as follows: cash bonuses worth 20% of overall target compensation, a long-term incentive program worth another 20% and finally restricted stock units and stock options worth between 20-23% each (salaries are the balancing item).

The annual cash bonus award depends on reaching specific targets for EBIT (80% weight) and Working Capital/sales (20% weight)

The LTIP award is dependent on ROIC (40% weight) calculated over a 3-year period and cumulative EPS (40% weight).

Restricted Stock Units are awarded based on the performance percentage achieved on the LTIP ROIC criteria.

The value of stock options granted annually approximates the RSU target opportunity for each executive.

I believe this is a sensible set of remuneration criteria, balancing growth with ROIC; I wish there was an element tied to cash conversion or FCF/share, but nonetheless it is certainly a reasonable set of criteria for this business and well aligned with minority shareholders’ interest.

Importantly, management leadership seems to be fostering a good company culture as evidenced by the strong rating on Glassdoor.

Historic Financials

Financial Algorithm

Management disclosed a long-term growth algorithm which appears conservative and sensible: the topline should grow organically at +3-5% p.a. and be augmented by bolt-on acquisitions worth 1-3% p.a, for a total revenue growth of between +4-8% annually.

Within the organic growth target, management believes that the repair/remodel industry grows at roughly GDP plus 1-2% and Masco’s brands aim to outpace the market growth.

Margins are currently in the high teens and should not expand much more: management clearly stated that it aims in each of the two businesses to outgrow the market (ie. share gains) and moderately expand operating margins (indicated in the range of +10bps p.a)

In addition, management targets to buyback c.2-4ppt of EPS growth p.a, bringing total average annual EPS growth around +10% p.a.

The targeted dividend payout of 30% leaves shareholders with an additional dividend yield of +1-2% (at the current stock price the yield is in excess of >2%).

Capital Allocation

Since taking over as CEO, Keith Allman achieved several important milestones which markedly improved the quality of the business: it reduced balance sheet leverage by 2x turns and divested low margin cyclical businesses at attractive multiples (cabinets at 9x EBITDA and windows at 11x EBITDA).

Furthermore, since 2014, the dividend has increased every year and buybacks reduced the diluted share count by -25% compared to FY13.

These actions created significant value for the shareholders, increasing the group returns (CFROI and ROIC) markedly relative to the last decade.

Going forward capital allocation priorities shouldn’t change, management aims to first reinvest in the business through a capex/sales of 2-2.5% and working capital around 16.5% of sales. Financial leverage should remain below 2.5x of gross debt/EBITDA and excess FCF after paying the dividend will be deployed into bolt-on acquisitions and buybacks.

Historic TSR

This is a business that over the last 10 years generated nearly +14% TSR p.a, well in excess of the global index.

Amongst its peer group, Masco is the second-best performing stock, a tad behind market leader Sherwin Williams.

Why the Opportunity Exists

The stock certainly suffered from (i) macro concerns over US residential housing (ii) several quarters of commodities driven inflation, particularly on the paint side (recall Sherwin raised prices cumulatively by over 30% in the last 1.5 years) and (iii) potential over-earning during Covid-19 (note consensus already expects EPS do be down YoY in 2023).

Furthermore, I believe the stock is still considered a highly cyclical low returns housing product business, and investors aren’t fully appreciating the extent to which the portfolio tilted to higher returns, more defensive end markets post the divestitures.

Finally, I would note that this stock isn’t for everyone: the customer concentration risk is very noticeable (35% of sales tied to Home Depot), however having dug more deeply into the relationship, I feel comfortable that there are no incentives for either parties to change the status quo.

Valuation

The stock trades on a c.7% FCF yield in 2023, which is attractive in my view both in absolute terms and relative to history. Recall, this business is less cyclical than other coatings or building products businesses, as it sells more defensive products (plumbing, paint) that hold up better during recessions.

At the recent Q4 2022 results management issued a rather conservative FY2023 outlook with revenues guided to be down -10% YoY, worse than consensus expected; yet the stock traded up on results day, suggesting that (i) expectations were already quite low and (ii) the outlook is rather conservative if compared with commentary from peers (for example Ferguson expecting only a low-single digit market decline).

Thanks for your writeups! I saw your analyse on Ferguson and Masco, do you know RCH.TO? I think it’s perfect for your. It’s Canadian company but a serial acquirer (Roll Up) in hardware.

I published the part 1 of a deep dive on richelieeu hardware is my substack yesterday wintergems.substack.com