This article is sponsored by THE+RECORD PLAYER by +AUDIO

I recently spent some time looking at Waste Connections (WCN US). In the following write-up I share my initial findings.

So far I concluded that WCN operates in a highly attractive industry and appears to be managed by a strong management team with a long track-record of growing FCFE/share whilst generating decent (albeit not exceptional) returns on capital (including goodwill). The valuation is probably at the upper end of what is palatable to many. Nonetheless, it probably reflects the company’s highly defensive, yet nicely growing, characteristics.

Disclosures

I and/or others I advise may or may not hold a material investment in Waste Connections. Everything expressed here is only my own opinion, it should not be relied upon, nor should be considered investment advice. Always do your own independent research.

Summary Investment Case

Attractive and resilient business model: through its exclusive focus on less competitive secondary and franchised markets, WCN generated sector leading profitability (FCF/sales c.16%) whilst remaining resilient to economic volatility (in 2020 EBITDA remained flat despite the Covid-19 pandemic).

Industry structure benefits incumbents: the waste disposal business in North America is characterised by (a) high regulatory barriers (permits, extensive regulation) and (b) high capital intensity (landfills require hefty upfront capital investment). These features favour the landfills’ owners’ incumbents which, over time, consolidate the industry, further improving their pricing power and returns on capital.

Aligned with a more sustainable economy: WCN has a long history of safely collecting, disposing and recycling waste. Its ESG credentials are therefore strong compared to the average company in the benchmark, thus making it an attractive proposition for an ESG-conscious portfolio.

Excellent management and capital allocation: the current tenured CEO (26 years) generated best-in-class TSR (+17% in the last decade) through executing a disciplined acquisitive strategy with focus on ROIC accretion and FCFE/share growth.

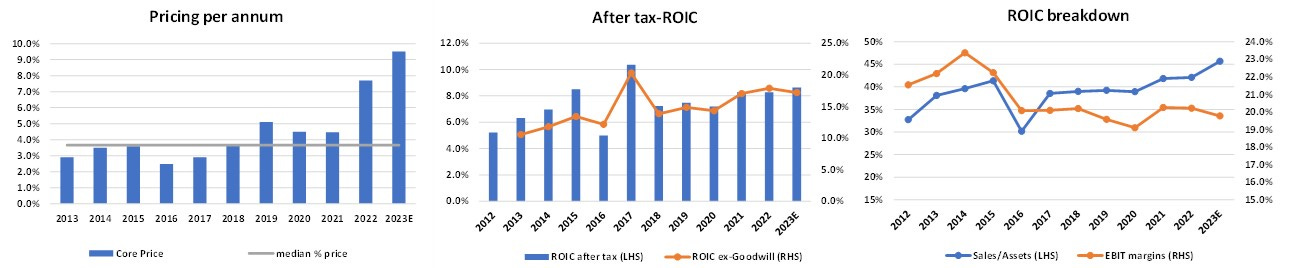

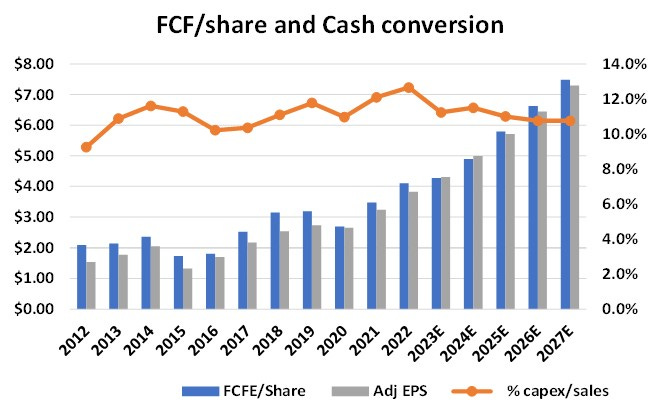

Attractive financial algorithm: mid-term growth can be thought of as +5-6% organic growth primarily driven by price (+4-5%) and bolt-on acquisitions worth +1-4% p.a, for a total revenue growth of 6-10% p.a; moderate margin accretion and buybacks lead to low/mid-teens EPS growth. Despite substantial capital intensity (capex/sales c.11%), cash conversion is excellent (L10Y >100%) and ROIC ex-goodwill is currently in the mid-teens range and rising.

Premium valuation: WCN trades on a premium valuation which can be justified by its defensive yet consistently growing FCFE/share profile; assuming an exit multiple in line with the historic median, it is possible to estimate a fair value per share around $205 in 2026 for a 4-year IRR of mid-teens from the current share price; in a more pessimistic “hard-landing” scenario, with the multiple derating to pre-2016 levels, the FV per share few years out is broadly in line with the current share price.

Key Risks:

Higher interest rates: higher financing cost could impact (i) WCN premium multiple and/or (ii) its acquisition strategy.

M&A risk: WCN strategy is heavily reliant on acquisition growth; failure to properly integrate acquired targets and/or failure to continue consolidating the industry would negatively impact the business.

Labour and trucks supply: in recent years significant wage inflation and limited truck availability impacted margins progression.

Regulation: changing regulatory requirements could lead to higher disposal costs and remediation responsibilities.

Structure of this Write-up

Business Description & Key Exposures

Brief History

Industry Background

Business Model & Strategy

Competitive Advantages

Management & Incentives

Summary Quality Assessment

Financial Algorithm

Capital Allocation

Financial Assumptions in Charts

Historic TSR

Peers Benchmarking

Alternative Comps

Valuation and Risk/Reward

Appendix (areas warranting further research, shareholders’ registry)

Main sources: 10K, Proxy Statement, company reports, transcripts, CS HOLT, Bloomberg, Goldman Sachs research.

Summary Thesis in Charts

Waste disposal in the US is an attractive, hyper-local industry, characterized by local oligopolies.

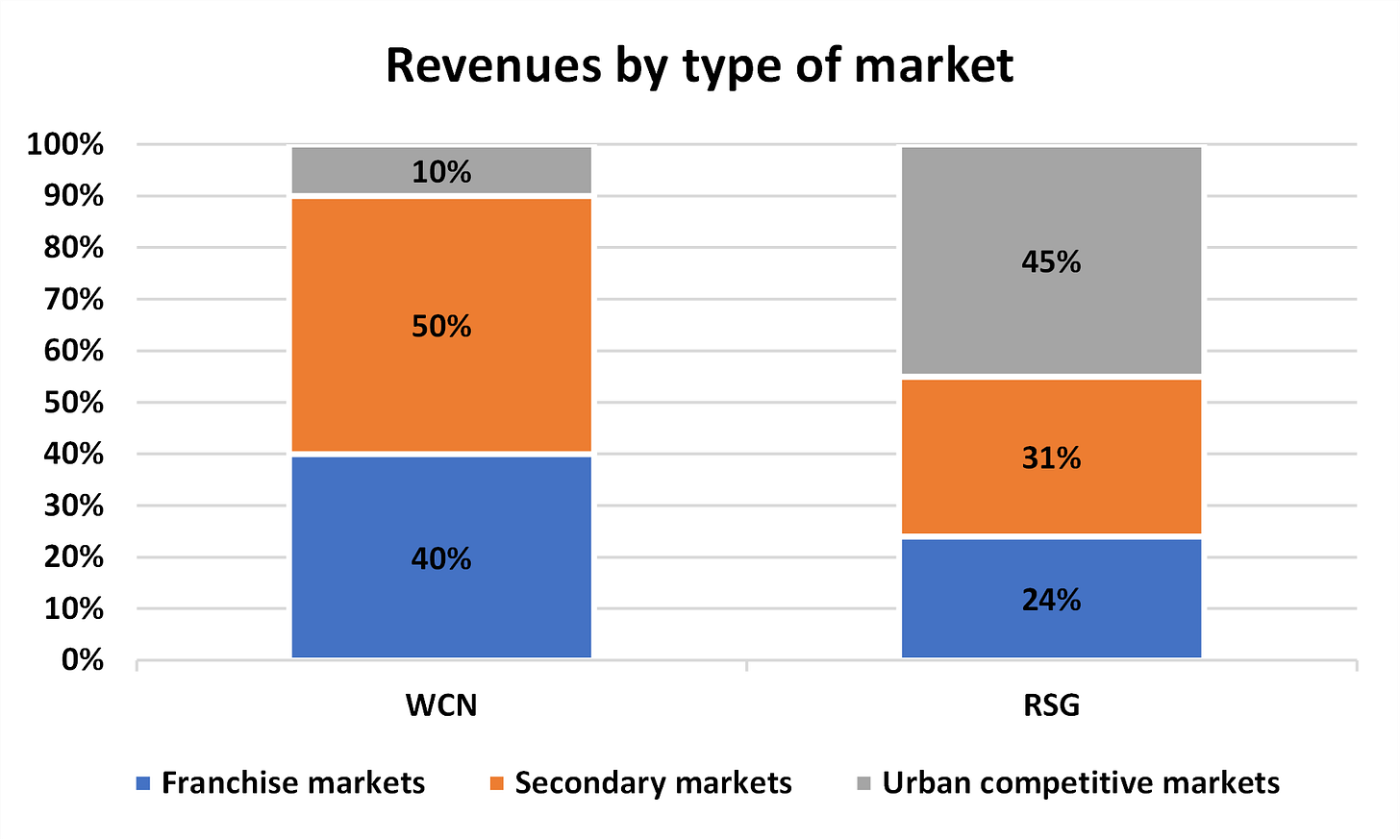

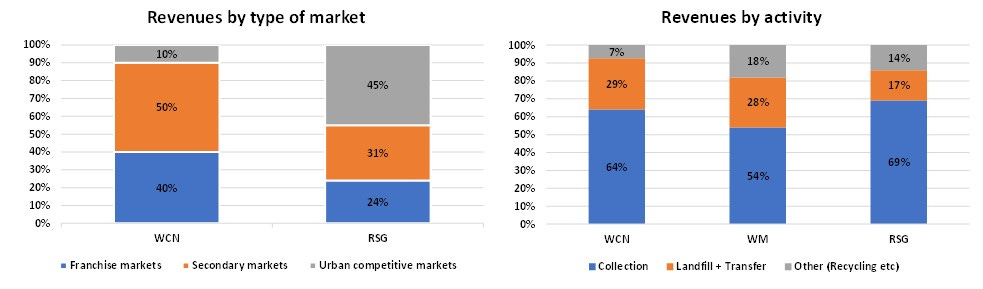

WCN differentiates itself from peers by focusing on less competitive secondary and franchised markets, which account for 90% of its revenues in total and lead to lower churn.

This, in turn, explains WCN’s strong pricing power and its sector leading profitability (c.32% EBITDA margin) and FCF margins (c.15%).

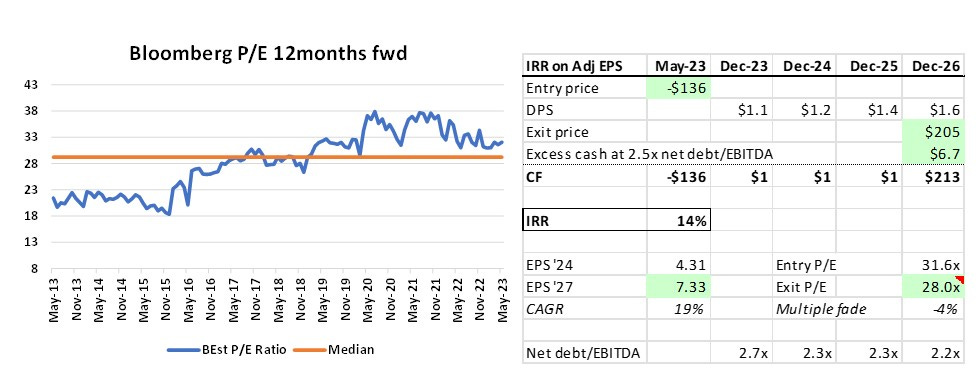

WCN stock currently trades on a premium valuation, understandably not palatable to many. Yet, assuming the stock retains its historic median P/E of the last decade – implying c.4% exit FCF yield – I estimate a fair value per share of $205 by 2026.

1. Business Description & Key Exposures

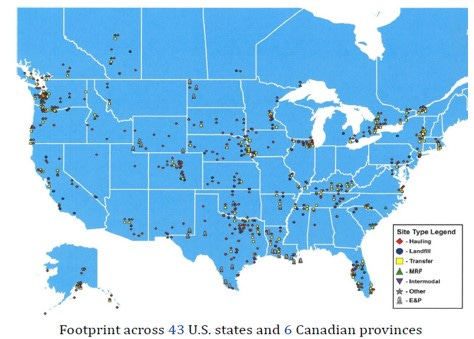

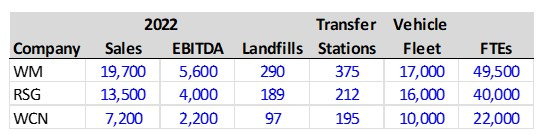

WCN is the third largest solid (non-hazardous) services company in North America, behind peers Waste Management (WM) and Republic Services Group (RSG).

WCN owns and operates 93 landfills around the country, offering collection and disposal services through its own fleet of 10,000 trucks and circa 22,000 employees.

WCN tends to avoid highly competitive large urban markets and instead focuses on rural or niche opportunities where it can attain higher market share and generate superior financial returns.

Franchised markets provide exclusivity in exchange for pre-established rates; because of significantly higher route density and very minimal customer churn, returns on capital in franchised markets are highly attractive.

In addition, WCN is primarily focused on collection, landfill and transfer revenues (93% of group), whilst its exposure to more volatile recycling activities is very limited (7% of sales) compared to peers WM and RSG (>15%).

2. Brief History

Under the leadership of CEO Ron J Mittelstaedt, Waste Connections was founded in 1997 through taking over Browning-Ferris’s (an ever-expanding waste disposal company) assets in the states of Washington and Idaho.

Following this initial deal, and within about a year of its founding, WCN decided to go public, launching its IPO in May 1998.

WCN expanded further very quickly, taking over tens of companies each year: by 2011 the company had operations in 32 US States and moved its headquarters to Texas.

In 2012, WCN announced one of its largest acquisitions by taking over R360 Environmental Solutions, a waste company focused on the oil industry for $1.38bn.

Few years later, in 2016, the company arranged the reverse merger of Canadian Progressive Waste Services for $2.7bn, relocating its tax headquarters to Canada.

3. Industry Background

It is of fundamental importance to distinguish between pure waste collection and waste disposal.

The former is a rather competitive business, where barriers to entry are relatively low, simply requiring trucks, employees and a customer base.

By contrast waste disposal is a much tougher industry to enter and succeed in: indeed, starting a new landfill operation is considerably challenging due to the extensive regulations imposed by both federal and state laws and the significant capital investments required.

Indeed, the process of obtaining the necessary permits for a landfill is burdensome due to opposition from local residents (commonly known as "NIMBY" - not in my backyard). Furthermore, constructing and operating a landfill requires hundreds of millions of dollar of upfront capital spend.

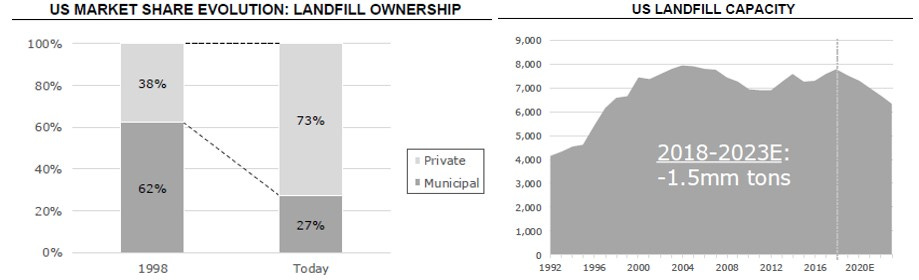

Owning landfills is of crucial importance to waste management companies, as the disposal cost of waste is heavily influenced by access to these facilities. Indeed, mom and pops operators must pay considerable tipping fees to landfill owners in order to dispose of their waste.

Large waste management companies that are vertically integrated benefit, therefore, from a meaningful competitive advantage through lower costs and economies of scale.

Importantly, US landfill capacity has been flattish since the early 2000s and is actually projected to decline going forward. In conclusion, landfills are scarce and precious assets.

The top-3 publicly listed players are all vertically integrated and control c.50% of the industry – worth c.$65-70bn in annual sales. The remaining c.50% of the industry remains heavily fragmented and spread amongst private and municipal players.

Due to the high cost of transportation and disposal fees, the industry is hyper local. According to a Goldman Sachs analysis, the average player controls c.45% market share around its landfill.

From a demand side perspective, what is attractive about the waste services industry is the relatively high level of stability of revenues through the cycle, as waste is generated and needs to be disposed of safely no matter the economic environment.

The resiliency of the industry and WCN in particular is visible in the financial performance delivered during the 2008/09 recession and over the 2020 pandemic (EBITDA was down -1%).

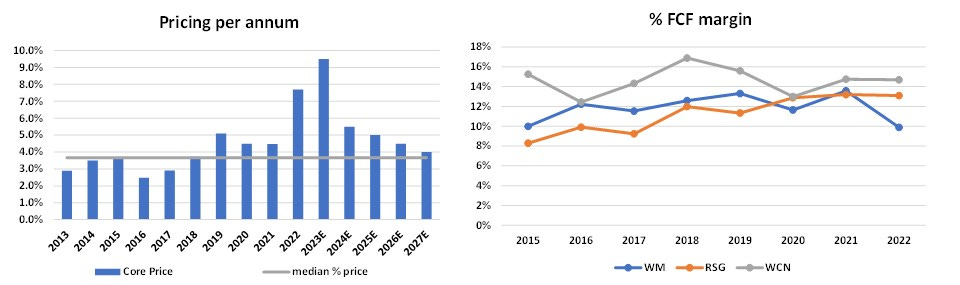

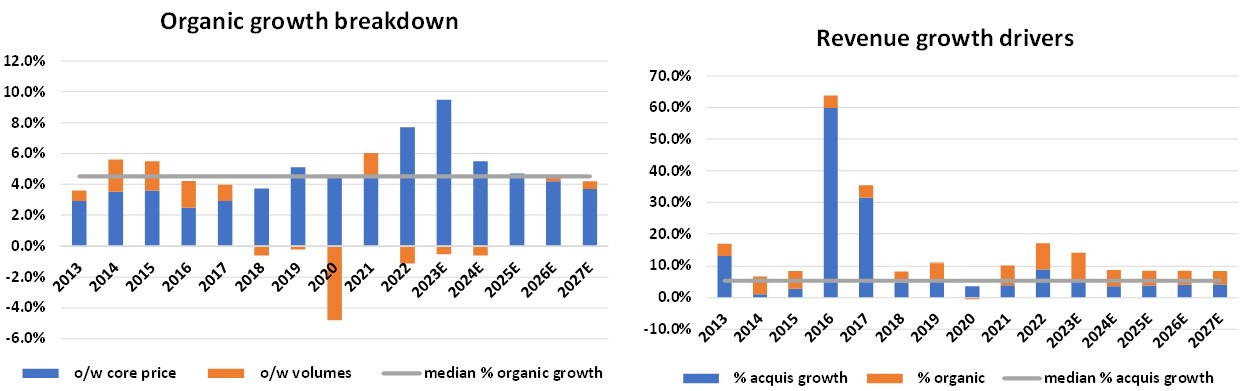

Over a mid-term time horizon, industry volumes tend to grow at low-single digit rate, in line with population growth; therefore, the majority of organic revenue growth historically has been driven by annual pricing, which for WCN averaged around c.4% p.a. over the last decade and picked up meaningfully in 2022-23 due to rising US inflation.

4. Business Model & Strategy

As previously mentioned, waste collection and disposal is an hyper-local business, where returns are primarily driven by:

Landfill ownership and location,

Route density,

Local execution.

Since its founding WCN focused over on owning valuable landfill assets in secondary franchise and rural markets, where competition is lower compared to larger urban-focused regions. The focus on niche markets helps reduce customer churn and increases profit margins.

In particular, franchised markets usually grant waste management companies exclusive contracts with very long duration (on average around 7 years but can go up to 15 years) with pre-established rates for specific territories, where higher route density over time leads to very good returns on capital.

As I understand, franchised markets tend to price off CPI or a pre-defined waste index, whereas WCN stated that on average it managed to price its contract up by CPI plus 150bps per annum.

In the waste collection and disposal business, scale matters as it provides greater utilization and leverage over a fixed cost base linked to the landfill ownership. Thus, increasing route density over time, via acquiring smaller waste collectors or winning new business, leads to economies of scale and higher returns on capital.

On average, WCN aims at adding +1% to +4% of annual growth via acquisitions, paying between 5-10x EBITDA multiple on average. Importantly, despite two decades of consolidation, the top-3 listed players still control only 45-50% of the industry, meaning that there are still plenty of M&A targets available going forward.

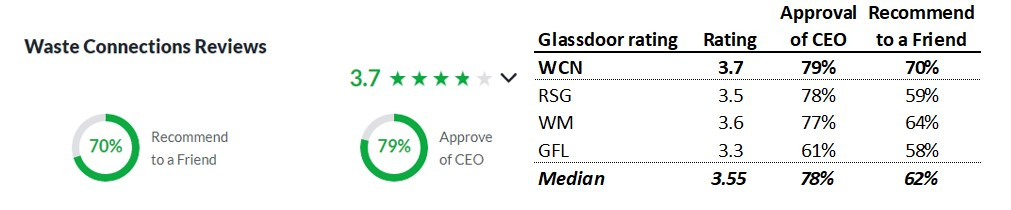

WCN’s management has delivered impeccable execution for many years and this is reflected in historic pricing power and superior shareholder value creation relative to peers. The company manages its operations on a decentralized basis, empowering local managers to make decisions and satisfy customers’ needs quickly thereby fostering accountability.

Furthermore, management states that its decisions are guided by what it calls a Servant Leadership approach, which inverts the traditional management hierarchy, positioning leaders to serve their employees, both professionally and personally. This approach prioritizes employees needs while fosters a culture of belonging and empowerment for the large workforce. Such features are reflected in the company’s relatively high ranking on Glassdoor.com, relative to its key competitors and its lower employees turnover rates.

5. Competitive Advantages

I believe Waste Connections enjoys a strong set of competitive advantage which are difficult to replicate and compete with:

Irreplaceable landfill footprint: the scarcity of landfills, discussed above as a result of strict regulation and “not-in-my-backyard” activism, prevents the approval and development of new landfills. Since the mid-2010s landfill capacity has contracted in the US, which strengthen the positioning of landfills owners such as WCN.

Vertical integration: as tipping fees are costly for waste haulers, high levels of internalization generate higher margins.

Route density: through increasing its market share via bolt-on M&A, WCN achieves greater utilization of trucks and landfills, strengthening its cost advantage relative to competitors and driving higher profitability.

Long-term contracts with indexation: collection and disposal services are governed by long-term contracts (on average 1-8 years depending on the customer) and c.40% benefit from automatic annual pricing indexation to CPI (or higher).

Differentiated culture: WCN’s decentralized structure empowers local managers and increases the workforce accountability.

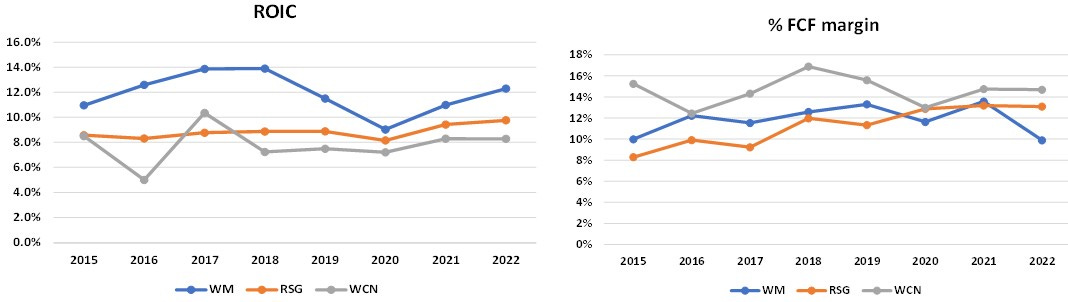

These competitive advantages translate into pricing power and decent returns on capital (including goodwill), as shown in the charts below.

6. Management & Incentives

WCN’s management team delivered a very impressive TSR since its IPO in 1998.

Strangely, in Apr-23, CEO Worthing Jackman was suddenly terminated, after 4 years in the role and 21 years at the company (covering roles ranging from IR, CFO and President).

Mr Ron J Mittelstaedt, chairman (over 2019-23) and CEO since founding in 1998 until 2019, was reinstated as CEO, while the chairman position was passed on to independent director - Mr Michael Harlan - on a non-executive basis.

This abrupt leadership change surprised me and certainly requires further investigation. I could not find much information online, nor on transcripts. Ideally, I would want to discuss it with IR.

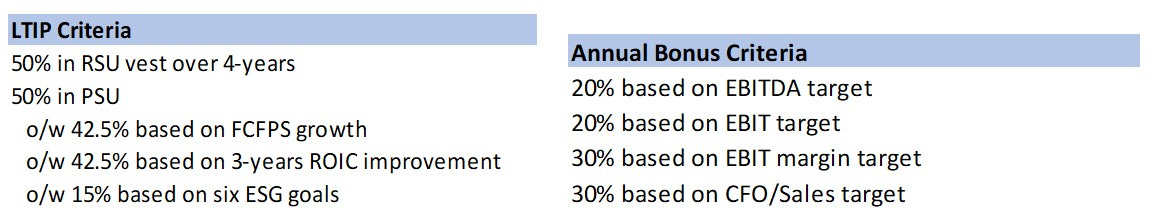

Management remuneration criteria are appropriately set and relatively transparent in terms of disclosure in the Proxy Statement.

As shown in the tables below, annual bonuses criteria are based on EBITDA, EBIT, EBIT margin and cashflow from ops margin.

More importantly, LTIP criteria balance returns metrics (ROIC) with FCFE/share growth and ESG targets. These criteria are fully aligned with long-term minority shareholders and should be commended.

Overall WCN management incentive remuneration appears amongst the best I have seen in a long time.

7. Summary Quality Assessment

WCN is a high-quality business operating in an attractive, defensive industry. It is a relatively simple business to understand, and disclosures are good and consistent over time.

WCN has a long history of succeeding in different economic environments and in my opinion is likely to be in a stronger position in 5-years’ time than today, thanks to:

Its continued efforts to consolidate the industry, which remains fragmented and

The relatively low risk of structural threat or tech disruption to the business model, given it deals with a rather basic yet fundamental service to the community.

WCN’s control of a network of landfills across the US is an important competitive advantage that acts as a major barrier to entry. Landfills are scarce and unique assets that enable vertical integration and higher margins. This strong positioning is further complemented by a shrewd strategy focused on secondary non-urban markets where competition is lower, further improving profitability and returns.

The business has pricing power, as evidenced by its average pricing action of +4% p.a. in the last decade and above average revenue visibility, thanks to multi-year contracts with high retention rates (estimated by analysts in the 90%+ range).

Management have historically acted as a prudent custodian of the business and deployed capital primarily into acquisitions with a disciplined approach, paying on average between 5-10x EBITDA multiples, depending on the target. I would expect this approach to continue unchanged going forward.

The biggest risks to the business are likely to arise from (i) failure to successfully integrate M&A targets, (ii) continued labour shortages and (iii) wage inflation rising above annual contract pricing.

8. Financial Algorithm

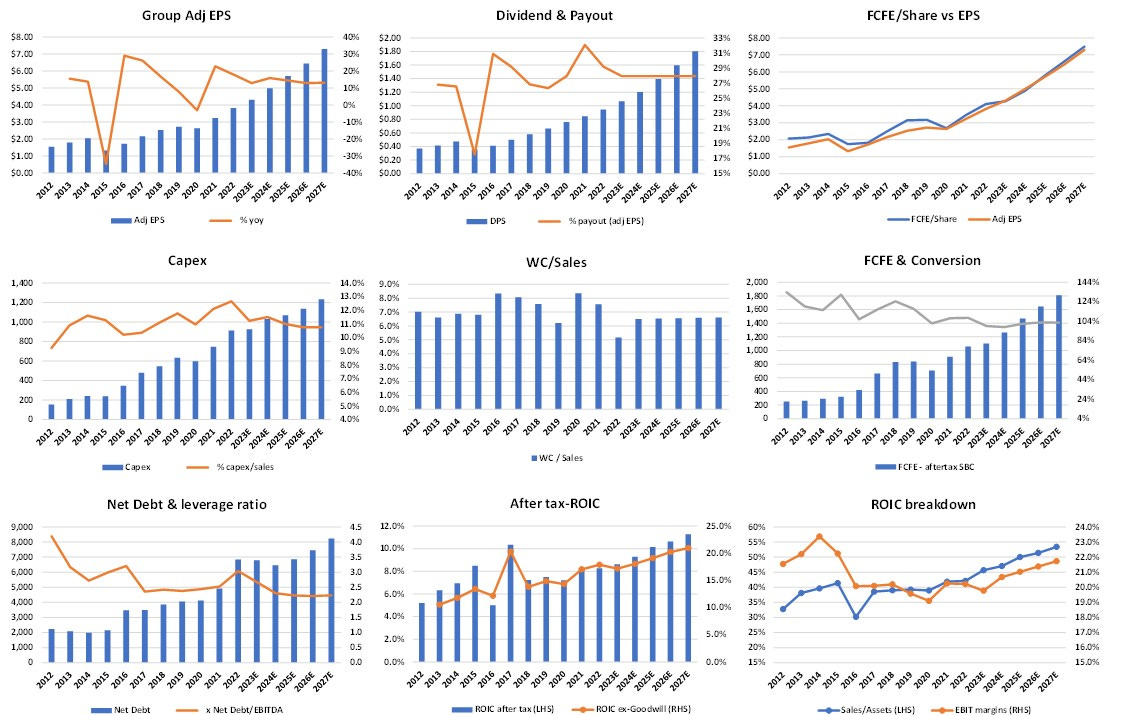

The table below compares the historic financial performance over 2012-22 with my forecasts for the period 2023-27.

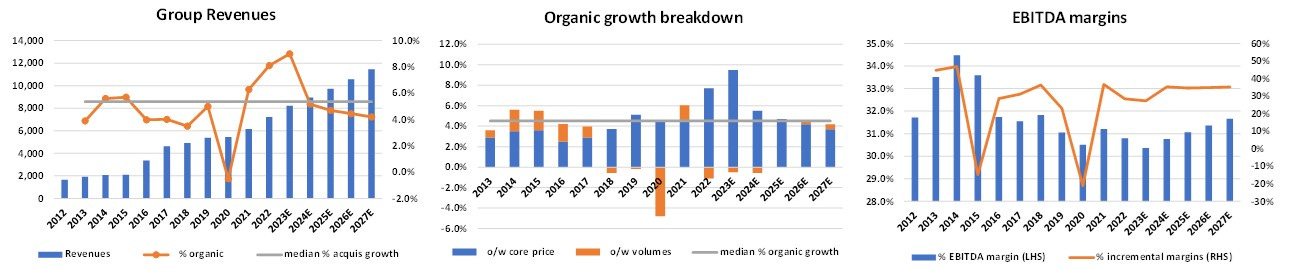

Over the last decade, WCN grew earnings primarily via revenue growth, both organically and through acquisitions. Organic growth of c.6% on average was driven primarily by pricing (c.5%) and complemented with annual bolt-on acquisition growth worth between 1-4% p.a. (except in 2017-18, following the large Progressive merger).

Volume growth historically has been low, and in line with population growth.

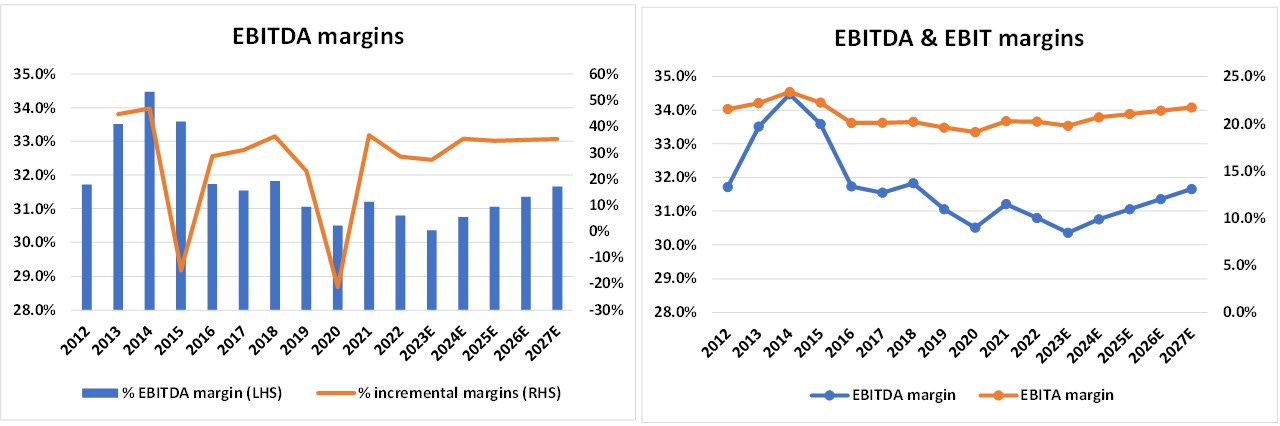

Margin accretion in the last decade has been limited, and this is a key area worth investigating further with management. I suspect this is due to M&A focused on acquiring smaller, lower-margin businesses that over time improve to the company’s average margin.

Despite significant capital intensity, with capex/sales averaging around c.11%, cash conversion has been excellent and consistently above 100% since 2013.

In the forecast period 2023-27, I’ve assumed revenue growth of c.9% is primarily fuelled by pricing (worth on average c.5.5%, driven by 2023 pricing guidance of 9.5%) and bolt-on acquisitions contributing on average c.4% p.a.

I’ve also assumed that volumes are down slightly YoY, to reflect the risk of a cyclical slowdown in the US economy in the next 12-18 months.

Earnings growth of mid-teens is further underpinned by a recovery in margins to around 31-32% (in line with management commentary for 2023-24) and buybacks reducing the share count by c.2-3% p.a.

In my forecasts, I assumed that the level of financial leverage on the B/S remains at the low end of the targeted range of 2.5-3.0x.

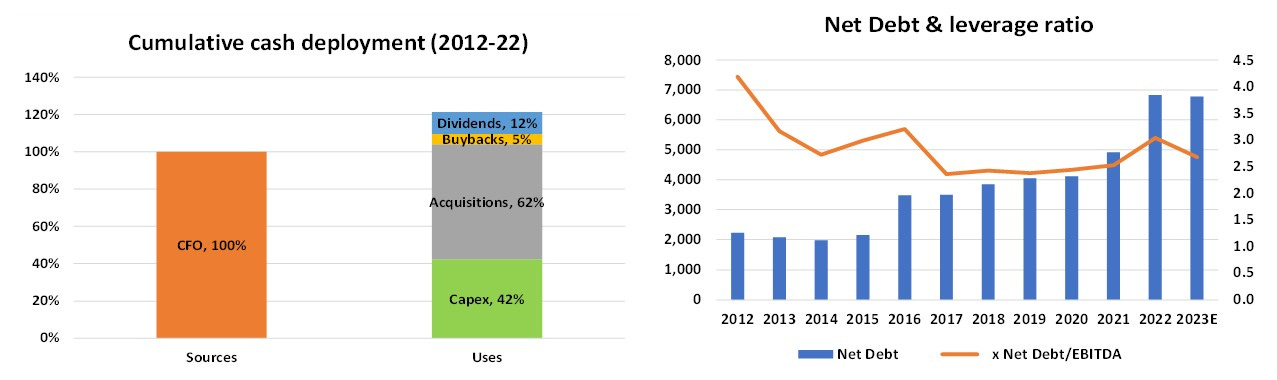

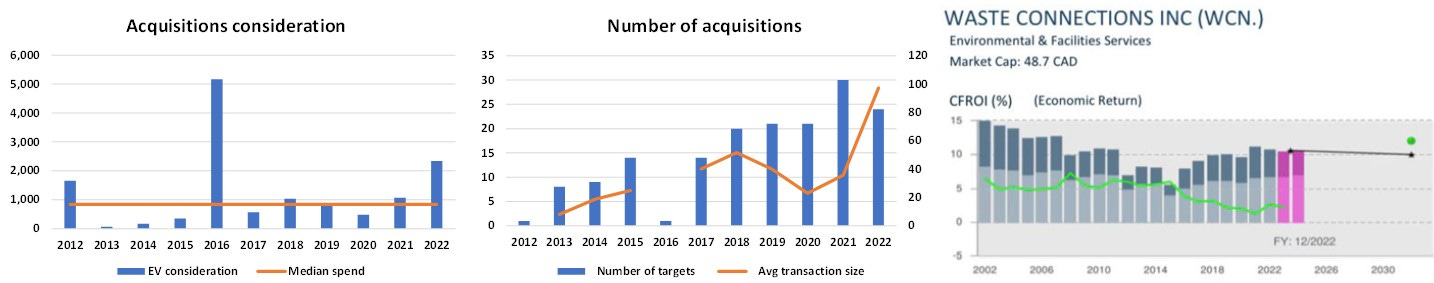

9. Capital Allocation

The first chart on the left below shows the c company umulative cash deployment over the period 2012-22.

After spending on capex (c.11% sales), the majority of excess cash has historically been deployed into acquisitions, whilst keeping the leverage ratio within a reasonable targeted range of 2.5-3.0x, not too aggressive for this relatively defensive business (see RHS chart above).

As far as I can tell, WCN’s approach to acquisition has been disciplined and selective, with management often reminding sellside analysts and shareholders that they pass on 80% of deals because they want to avoid competitive bidding processes.

Historically, WCN aimed to execute 15-20 annual transactions, acquiring $150-200mn in sales, and spending about $0.5bn. Lately, more family-owned businesses are coming to market due to increasing regulatory oversights and costs, which favours WCN as management courted these families for years.

On average, the pre-Great Recession multiples paid for deals were around 10x EBITDA; during the GFC these obviously fell (to as low as 5-7.5x) and in the last few years moved back up to around 10x.

The focus on small deals reduces the risk of disruptive M&A, even though the large transactions of 2012 and 2016 were integrated well, as evidenced by the steady transaction CFROI profile of the group over time (last chart below on the right).

10. Financial Assumptions in Charts

I’ve tried to put together a simple financial model to come up with reasonable estimates for the period 203-27. The charts below summarize the assumptions embedded into the model.

11. Historic TSR

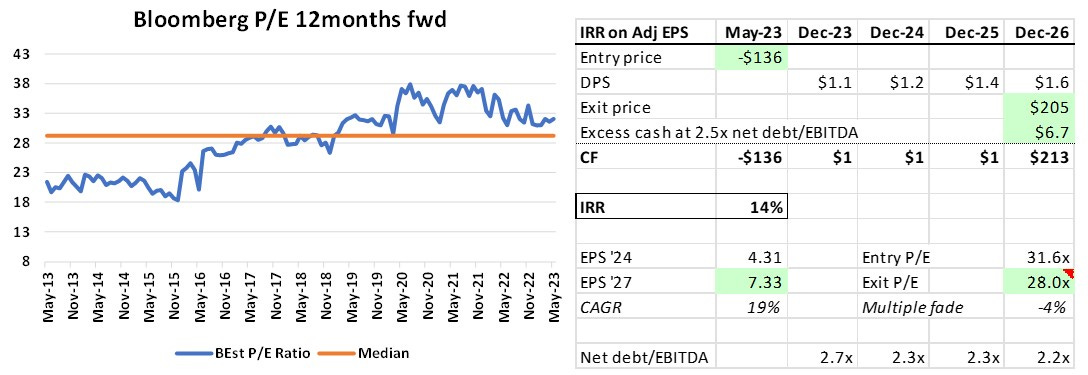

Since 2013 TSR compounded in the high teens, well ahead of the global MSCI equity index.

WCN’s TSR over 2013-23 can be broken down approximately as (i) earnings compounding of c.+10% p.a, (ii) rerating of c.+5% p.a and (iii) dividend yield of c.1%.

12. Peers Benchmarking

The most obvious peers to note are obviously Republic Services Group (RSG) and Waste Management (WM).

There are some nuances between the different players, some of which I still need to dig into.

Having said this, at a high level, WM is by far the largest listed player in the industry, with a revenue base more than twice larger than WCN and this is important, as scale matters in the industry and may explain why WM’s accounting returns (ROIC) are higher than WCN and RSG.

On the other hand, WCN is the most profitable listed player, with a FCF margins in the mid-teens, and this is in turn reflected into its premium multiple relative to its direct comps.

13. Alternative Comps

I believe WCN could be compared to other density-driven businesses, such as aggregates, less-than-truckload and equipment rental businesses in the US.

These peers share similar financial profiles to waste services businesses, as can be seen in the first table below.

Compared to these alternative sub-sectors, WCN appears to offer:

Similar growth, but of higher quality (i.e. certainly less cyclical and more defensive).

Similar capital intensity (ex-equipment rental).

Slightly higher profitability as measured by EBITDA margins (except than for the equipment rental companies, which nonetheless have higher capex/sales ratios).

Superior cash conversion (measured as FCF/EBITDA).

Looking at valuation multiples, on a FCF yield basis, WCN trades broadly in line with the aggregates stocks (Vulcan Materials, Martin Marietta), around 3.7% FCF yield using Bloomberg consensus estimates.

14. Valuation and Risk/Reward

The trickiest part of WCN’s investment case is the valuation, which is probably at the upper end of what most find palatable (including myself). The stock is trading on around 29x P/E in 2024 and EV/EBITDA of 16x.

Nonetheless, it could be argued that these high multiples are a reflection of the business highly defensive yet nicely growing characteristics. There are not many non-tech businesses that have seen EBITDA flat YoY during the 2020 pandemic and have also compounded FCFE/share growth in the mid-teens over a decade.

A constructive approach to valuation would consider the risk/reward offered under two different scenarios: in my base case scenario, I assume the US doesn’t fall into a severe recession and the multiple remains elevated and in line with the historic median. I thus estimate a fair value per share of $204 in 2026 for a 4-year IRR of 14% p.a from the current share price.

In a more pessimistic “hard-landing” scenario, with the multiple derating to pre-2016 levels, the FV per share several years out appears broadly in line with the current share price.

15. Appendix

Areas warranting further research:

Investigate recent termination of President and CEO (Mr. Worthing Jackman) and return of chairman (Mr Ron Mittelstaedt) to the CEO role.

Question management on limited EBITDA margin accretion over time, despite doubling revenues over since 2016.

Risks to labour and truck supply - explore with management potential mitigants to these downside risks.

Dig deeper into different nuances of two listed competitors WM, RSG.

Higher rates - consider implications for future capital deployment priorities.

Renewable Natural Gas (RNG) project: discuss unit economics and upside risk to 2026 EBITDA.

Shareholders’ registry:

I note several quality-focused funds on the registry (WCM, MFS, Bill & Melinda Gates Foundation, Fiera Capital).

Disclosures

I and/or others I advise may or may not hold a material investment in WCN. Everything expressed here is only my own opinion, it should not be relied upon, nor should be considered investment advice. Always do your own independent research.

Good writeup Marathon, the company has a very strong track record. Apologies if I didn't quite pick it up through the report, but wondering about your view of margins. For what appears to be a very steady earner, EBITDA margins have moved around quite a lot. What do you put the decline to over the last decade and what are you basing the recovery of margins on in your forecasts?

Good writeup. Throwing it on my list of names to dig deeper into. Roughly, seems hard to like it at current multiples -- but need to understand it better.