London Stock Exchange (LSEG)

An in-depth analysis of LSEG/Refinitiv merger - marriage isn't easy.

In Aug-19, the London Stock Exchange Group (LSEG) announced it would acquire Refinitiv (formerly known as Thomson Reuters Financial & Risk) for a deal value of $29bn, the largest transaction in LSEG’s history . I was recently asked to analyse the transaction. I share my findings in the post below.

Disclosures

I and/or others I advise may or may not hold a material investment in LSEG. Everything expressed here is only my own opinion, it should not be relied upon, nor should be considered investment advice. Always do your own independent research.

Summary Conclusions

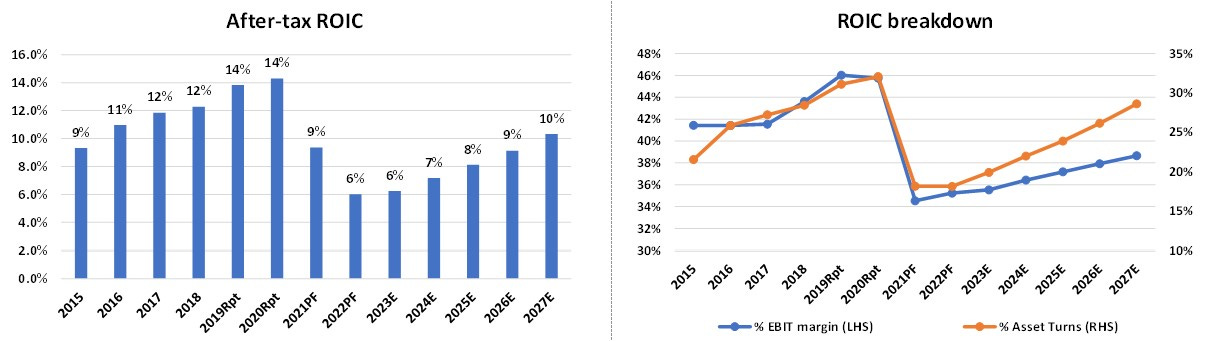

The Refinitiv acquisition likely destroyed shareholders’ value: the Refinitiv deal will generate a low after-tax ROIC of c.6% including cost synergies. Whilst the proportion of recurring revenues increased to 70%, capital intensity also increased, and margins reset lower. Furthermore, the transaction did not resolve LSEG’s lack of vertical integration in derivatives, the exchange sector most attractive segment.

Enlarged group is good, not great: pre-merger, LSE standalone owned two leading franchises (FTSE-Russell indices and LCH Clearing) with strong competitive positioning and deep moats. Refinitiv diluted these as it brought with it several mediocre and under-invested businesses (e.g. Eikon Desktop, ThomsonOne Wealth, FX Matching) together with leading properties such as Tradeweb and Third Party Risk Solutions. Overall, LSEG and its diversified set of assets warrants a quality rating lower than leading exchange groups and financial data companies such as CME, S&P Global.

Reinvestments to dampen operating leverage: the company is still catching up with better invested competitors (e.g. Bloomberg, Factset), as evidenced by (i) its higher capex/sales ratio, (ii) spend on expensive bolt-ons to bolster existing product portfolio (at EV/sales 10x) and (iii) increased cloud spend partnership with Microsoft. As merger costs synergies will be exhausted by FY24, from FY25 the cost base is likely to increase at a greater pace than consensus expects.

Defensive characteristics and solid growth algorithm: LSEG is a defensive asset with c.70% of revenues subscription-based and an additional c.10% from non-discretionary trading (derivatives clearing). It enjoys c.90% gross margin and generates significant FCFE (c.£1.7bn and growing); EPS should grow in the low-teens, comprising of +6% from organic growth, +2% from cost synergies and margin accretion and +4% from buybacks.

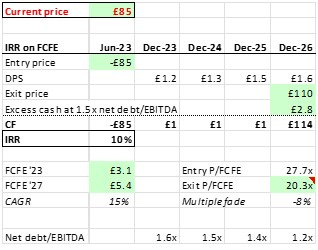

Valuation not yet sufficiently attractive: following a reset of expectations in March 2021 at the FY20 results, the stock returned to a more normalized valuation. Nonetheless, I estimate an IRR of low-teens at best using an exit multiple of 20x P/FCFE, which isn’t sufficiently enticing to recommend starting a position.

Structure of this Write-up

Company Profile & Brief History

Key Exposures

Industry Structure and Context

Analysis of Refinitiv Transaction and Detailed Quality Review of Acquired Assets

Competitive Advantages

Capital Allocation

Management and Incentives Remuneration

ESG Considerations

Overall Quality Assessment

Financial Algorithm and Charts

Valuation

Appendix

Main sources: company reports, Tegus and Third Bridge transcripts, Redburn, CS HOLT, Bloomberg, ValueInvestorClub.com, Scuttleblurb.com.

Summary in Charts

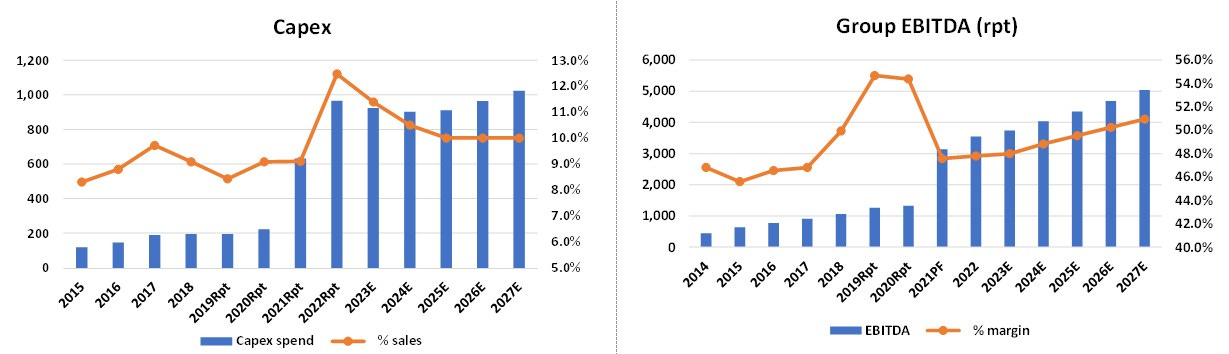

Refinitiv diluted the quality of LSE original standalone business: (a) the transaction increased capital intensity;

And (b) decreased margins and asset turns, lowering group ROIC.

Following a reset of expectations in March 2021, the stock returned to trade in line with its historic median multiple of 22.5x P/E. I estimate a value per share of £110 by Dec-26, using a FCF yield of 5% at exit.

1. Company Profile & Brief History

With 300 years of history, LSEG is today one of the largest market infrastructure and data businesses in the world, serving 40,000 clients in 190 countries through its 23,000 employees.

In the 2000s, exchanges enjoyed a golden era post demutualization, benefiting from the dual protection of favourable regulation and scale. However, in 2007, with the introduction of Mifid I, the so-called “concentration rule” - which forced equities to be traded only on regulated markets - was abolished, thus heightening competition between national stock exchanges and alternative venues such as multilateral trading facilities (MTFs).

Facing this significant headwind, Xavier Rolet was appointed CEO of the LSE in May 2009 and swiftly transformed the prospects of the group through a series of strategic transactions:

The acquisition of Millennium IT (2009) and Turquoise Holdings (2010) helped LSE’s capital markets business to remain competitive vis-à-vis disruptive MTFs in Europe.

The acquisition of FTSE (2011) and FrankRussell Company (2014) allowed LSE to become the third player in the highly lucrative and growing index business.

The acquisition of LCH Clearnet (2013), led LSE to dominate the interest rate swap clearing market.

Following these deals, the contribution from LSE’s challenged capital markets business fell from c.70% in FY08 to c.15% in FY17.

The last deal orchestrated by Mr Rolet was an attempt at making the LSE a meaningful player in the derivatives market. Yet the proposed merger with Deutsche Börse in 2016 was blocked circa one year later by the EU Competition Commission and as a consequence, towards the end of 2017, Mr Rolet stepped down (to the disappointment of many). Overall, Rolet’s eight years tenure saw the LSEG stock price compound at an astonishing +25% p.a, compared to the MSCI World index at +15% and FTSE100 at +11%.

In Apr-2018, an ex Goldman Sachs partner and banker, David Schwimmer was named group CEO. He surprised markets in Aug-2019 announcing a mega-merger of $27bn with Refinitiv, a large financial data provider, formerly known as Thomson Reuters Financial & Risk, owned by Blackstone (who bought a 55% stake in 2018).

Effectively, the transaction could be considered a reverse takeover: Refinitiv FY18 annual revenues of £4.3bn were more than double LSE’s revenues of £2.1bn, and the total number of employees jumped from c.5,000 to c.24,000.

Whilst the deal was initially welcomed by the market (LSEG stock price rallied +75% until March 2021), the release of FY2020 financial results led to a reset in market expectations, as management announced the integration would require an additional £1bn in investment spend to support achieving cost and revenue synergies. The stock dropped c.20% in one-day to about the current share price of c. £80/share.

2. Key Exposures

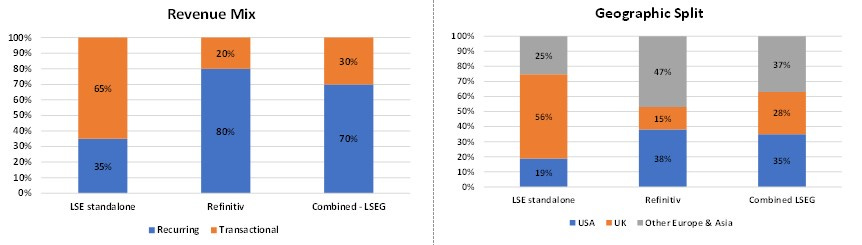

Prior to the merger, LSE standalone generated the majority of its revenues from trading related revenues (c.65% of total) primarily from its capital markets and derivatives clearing businesses. The addition of Refinitiv’s large financial data distribution businesses increased the exposure to recurring subscription-based revenues to c.70% of total.

From a geographic standpoint, the enlarged group is a much more global business, as Refinitiv brought a strong and established presence in North America and Asia.

Following the merger, LSEG reports across 3 divisions, Data & Analytics, Post Trade and Capital Markets.

The Data & Analytics division is where the majority of the acquired Refinitiv assets sit, although acquired trading platforms Tradeweb (in fixed income) and FXall (in foreign exchange) are reported within the Capital Markets division.

The Post Trade division remains unaltered and includes revenues generated by LSE’s crown jewel asset, the central clearing house and natural monopoly LCH Clearing.

Before delving deeper into the merger, it is helpful to first briefly explain how the exchange industry evolved over the last two decades towards combining market infrastructure assets with financial data providers.

3. Industry Structure & Context

We discussed most of these industry trends in my Euronext review, however it is worth sharing these again for those that aren’t familiar with the sector.

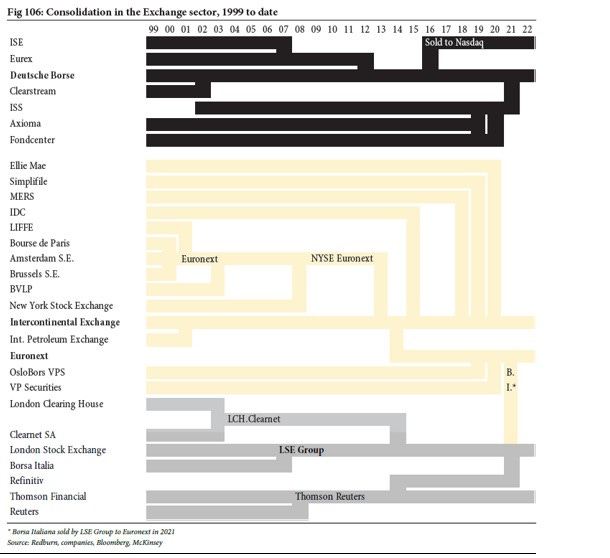

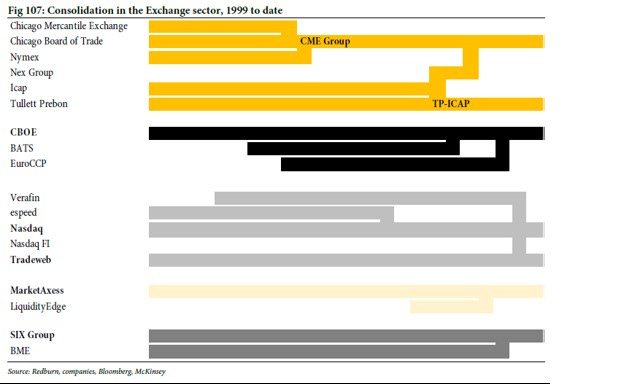

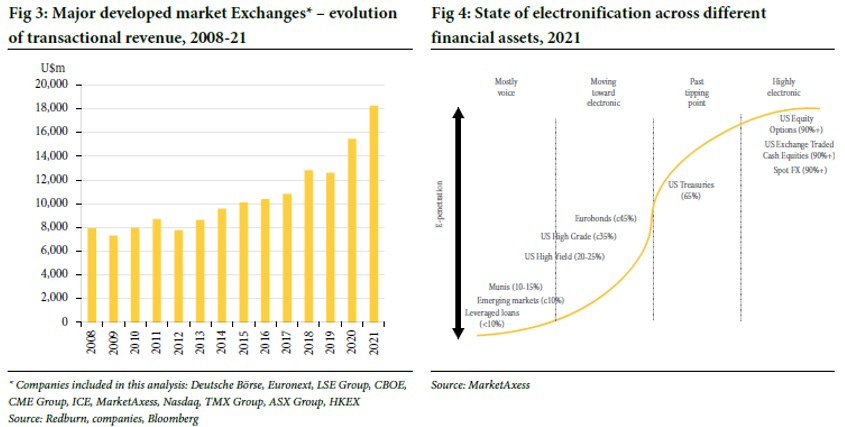

The exchange industry benefits from scale and network effects, governed by the law that liquidity begets further liquidity. This is one of the main reasons why over the last two decades the sector experienced several waves of consolidation, both in Europe and in the US, leading to very few operators dominating the industry.

In Europe, the premier operators are the London Stock Exchange Group (LSEG, $50bn market cap) and Deutsche Börse (DB1, $35bn), whereas Euronext is a smaller, less global operator (ENX, $8bn) which I had reviewed not long ago.

In the US the largest operators are the highly profitable vertically integrated derivatives exchanges Chicago Mercantile (CME, $70bn) and Intercontinental Exchange (ICE, $60bn), followed by smaller competitors Nasdaq (NDAQ, $27bn) and CBOE (CBOE, $14bn).

LSEG is the most global of the three European operators, and prior to the merger with Refinitiv it was primarily operating (i) an established index business in North America and UK (FTSE Russell), (ii) a European equity trading operation (via the LSE equity exchange and dark-pool platform Turquoise) and (iii) LCH Clearing, the leading clearing house for interest rate swaps globally.

The greatest value creation from consolidation occurred at ICE, CME, which were able to vertically integrate derivatives trading with derivatives clearing, effectively establishing very strong natural monopolies in their respective asset classes. It is no coincidence they are able to generate sector leading profitability (with EBITDA margins >60%).

By contrast, LSEG failed at getting vertically integrated exposure between derivatives trading and clearing (its attempt to merge with Deutsche Börse in 2016, was blocked by the EU Competition Commission). Because of this, one unique feature of LSEG is its open access model, that is, it offers clearing services to competing trading venues. Other competitors instead operate closed silos, meaning customers trading on their venues need necessarily to clear with them as well.

It is noticeable that historic consolidation wasn’t driven by lack of growth: over 2010-21, industry transaction revenues grew at an average compound growth rate of +7%. Trading volumes on exchanges benefited from three important structural growth drivers (i) the increased electronification of capital markets, (ii) the high level of innovation and increased risk sophistication of investors and (iii) increased regulation post Great Financial Crisis aiming at increasing central clearing of financial instruments (to avoid repeating the post-Lehman nightmare).

Over the last decade, the various boards of listed exchanges groups cleverly mandated management teams to reinvest the excess FCF coming from their growing trading revenues into developing new business lines based on the proliferation of data generated on exchanges. Thus, over time, the provision of data and financial information became a second major source of revenue growth for the exchange industry globally.

Non-trading related revenues could be considered as of “higher quality” as they tend to be contractual and recurring, offering greater stability than trading related revenues; however it is important to be selective, as not all “recurring revenues” are of equal quality, as we shall see with Refinitiv’s Trading & Banking Solutions business in the next section.

Those exchanges that were able to generate proprietary data, that is, unique transactional data not available or replicable elsewhere, enjoyed strong pricing power on their data revenues. Exchanges with exposure to derivatives and/or other OTC instruments benefited from particularly strong proprietary data.

In this context, LSEG’s historic focus on equities traded on-exchange, led to an inferior ability to monetize market data from its trading venues. It is this background that led to the merger between Refinitiv and the LSE.

4. Analysis of Refinitiv Transaction

In Aug-19, LSEG announced the merger with Refinitiv, owned by Blackstone and Thomson Reuters, for a total consideration of $27bn. The transaction was reviewed by the European Competition authorities with limited remedies (primarily the divestiture of Borsa Italiana) and the deal closed on Jan 29th 2021.

Refinitiv is amongst the largest financial data providers in the world, serving 40,000 customers in 190+ countries, through both its terminal desktop and data feed businesses, which compete primarily with industry leader Bloomberg.

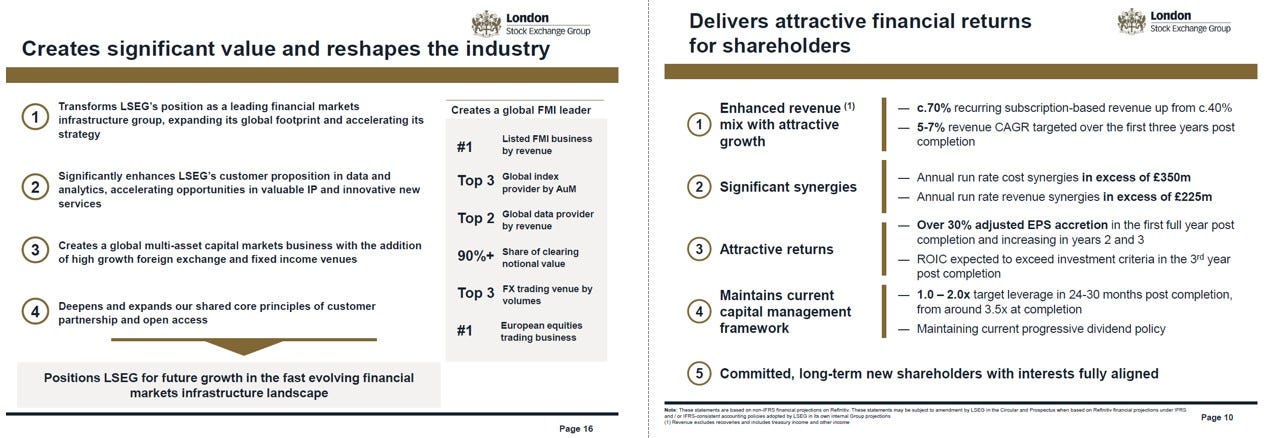

The main strategic rationales provided for the merger were:

Provide LSE with multi-asset class capital markets functionalities, adding fixed income (Tradeweb) and foreign exchange (FXall) trading venues to LSE’s legacy European equities trading business.

Integrate these enlarged trading facilities with Refinitiv’s well established data content management, analytics and global distribution capabilities which are rivalled only by Bloomberg.

Scale up the group size and reach to be able to be considered with heavy-weights ICE, CME.

The headline price paid did not initially appear too expensive (12x EBITDA); management stated the deal was expected to deliver c.30% EPS accretion in year 1 and ROIC in excess of cost of capital in year 3.

While the above rationales appear sensible, I believe the transaction destroyed shareholders value.

To begin with, LSEG CEO David Schwimmer overpaid for Refinitiv: I estimate an after-tax ROIC of just c.6% in year 3 even if I factor in the £400mn targeted cost synergies and assume a generous sales growth rate over time, relative to Refinitiv’s historic lacklustre performance. Furthermore, if I were to add the surprisingly large catch-up capex needed post deal closure, the ROIC on the transaction would drop even lower.

Secondly, the transaction did not resolve LSEG’s historical lack of exposure to vertically integrated derivatives trading and clearing, leaving it instead with an enlarged horizontal trading footprint across asset classes (with the addition of FX and fixed income). Therefore, perception of the group as a diverse capital markets conglomerate remained largely unchanged.

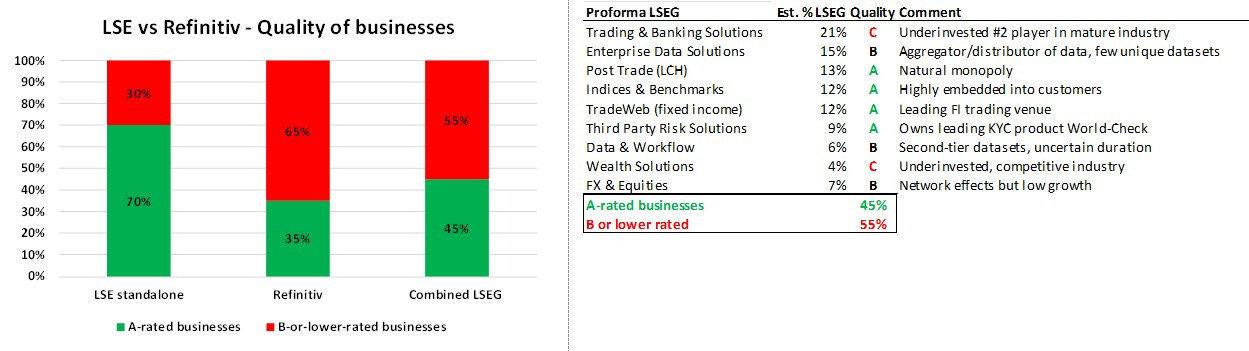

Thirdly, the quality of the assets acquired is lower than LSE’s standalone portfolio of businesses, most of which were “A-rated” assets such as the (i) highly successful FTSE-Russell index business and (ii) the exceptional natural monopoly LCH Clearing. Refinitiv by contrast is made primarily of B-or-lower-rated businesses, and several of its assets suffered from underinvestment under the Thomson Reuters’ ownership.

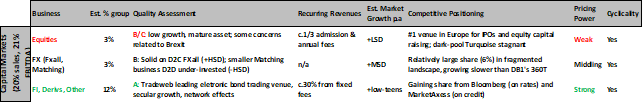

Proforma for the merger, I estimate that c.45% of the enlarged group is made of high quality A-rated businesses (Indices & benchmarks, Third Party Risk Solutions, Tradeweb, Post-Trade), whilst the remainder c.55% B-rated or lower quality assets face either slow growth (Equities) or underinvestment (Trading & Banking Solutions, Wealth Solutions) and strong competition (Enterprise Data Solutions, FX Matching).

In conclusion, this decline in quality is visible at the aggregate group level, through increased capital intensity (from c.8-9% to c.10-11%), reduced group proforma margins (from >54% to c.45%) and diluted ROIC (including goodwill).

Before digging deeper into Refinitiv’s various businesses, it is worth giving some further background on the original entity: the business was previously known as Thomson Reuters Financial & Risk (TRFR) and was formed through the merger in 2012 of Thomson Financials with Reuters.

TRFR underperformed its competitors for nearly a decade: indeed, several recent interviews with ex-executives mentioned “countless acquisitions were poorly integrated and resulted into a mishmash of technology, old and new” which were further plagued by a “lack of accountability” and significant management turnover (one expert interview mentioned that “in 6 years I had 8 managers”).

The only real attempt at harmonizing systems and products started under Blackstone ownership in 2018: one expert worryingly highlighted that “Thomson clearly wanted to exit the investment, […] they’d put a little money into it [Refinitiv] but it was a lot of top dressing, just really getting the business ready for sale”.

These group-wide concerning comments require further qualifications, as not all of Refinitiv is in dire straits; the next section rates separately each sub-segment for both the Data & Analytics and Capital Markets divisions where most of the acquired Refinitiv’s assets reside (recall the Post-Trade division was unaffected by the merger and includes legacy LSE’s LCH Clearing business).

4b. Detailed Quality Review of Acquired Assets

In the Data & Analytics division, approximately two thirds of revenues come from Refinitiv assets; the most important sub-segments are Trading & Banking Solutions, Enterprise Data Solutions and Investment Solutions.

Trading & Banking Solutions - rated C - is a mature, underinvested business that has been losing share for a decade (c.20% share today) vis-à-vis market leader Bloomberg (c.35% share) and more agile smaller competitors such as Factset (c.5-7%) and S&P Global (c.6-7%).

The business provides pre-trade data and analytics to sell-side brokers, asset managers and advisory clients through its legacy desktop offering Eikon, and its newer cloud-version Workstation which has been rolled out to c.50% of clients in 2022.

For years this business struggled vis-à-vis Bloomberg’s leading terminal offering, primarily due to poor user interface, lower speed, and a confused sales proposition (there were 20 different product offerings, some competing with each other). Several experts’ interviews highlighted that the only way Refinitiv historically won against Bloomberg was by undercutting it by 40-50%, which they did routinely with the bigger banking clients.

Since Blackstone acquired Refinitiv in 2018, significant investment has been plowed into the platform to improve the product and stabilize share losses (c.$170mn according to the prospectus). Furthermore, a new divisional leader was brought in and the salesforce and product offering was restructured.

It is likely that this business will continue to require investment both in the form of opex and capex to unify the different tech platforms and M&A to fill missing capabilities (the recent TORA acquisition for £260mn is an example, bringing a modern execution platform that Workstation couldn’t yet offer).

Tegus experts’ interviews seem confident that market share stabilization has likely been reached, but it remains extremely difficult to displace the incumbent Bloomberg; at best Refinitiv could claw back some market share from Factset in the coming years.

My own primary research based on calling Refinitiv in London suggest customer service remains very poor: it took Refinitiv one week to contact me via email following my first enquiry; arranging a demo of the new Workstation product with a sales specialist required another week and a lot of pressing – strikingly poor if compared to Bloomberg’s renowned customer service.

Enterprise Data Solutions - rated B - is one of the crown jewels of Refinitiv’s portfolio: the business sells real-time and reference pricing data through an open platform approach and via APIs that can integrate directly with end-users applications. The business sources data for 2.6mn instruments from >1,000 exchanges and distributes to thousands of clients around the world.

This business is a duopoly where Refinitiv is #1 with c.45% of the market, followed by Bloomberg with c.20% share, according to the European Commission’s merger review document .

Barriers to entry in this business are high as (i) the entitlement systems that sit behind the feed services are enormously complex, (ii) accessing and maintaining 25 years of raw data for 2.6mn instruments, cleaning it, normalizing it, and distributing it to end clients in a timely manner is hard (iii) switching costs for customers are high, as data feeds are embedded into many applications.

The reasons why I nevertheless rated this business down as B-rating instead of A are (1) most distributed data is not unique nor proprietary (ie. it is possible to source it from alternative venues, for example from Bloomberg), thus it has limited pricing power compared to unique proprietary transaction data, (2) the business has actually been facing price pressure in the last 3 years, as Bloomberg, in an effort to further strengthen its bundled approach, started offering data to its top clients at very low prices, undercutting Refinitiv (note the top 50-60 clients account for 60-70% of revenues in this segment, according to a Third Bridge expert interview), and (3) divisional historic growth of +4-5% lags behind competitors data businesses such as S&P, Bloomberg, Factset growing at double digit rate.

At this point it is important to mention the recent 10-year strategic partnership signed with Microsoft in Dec-2022 to speed up the migration of LSEG data and infrastructure to the cloud.

The deal is important for both the Enterprise Data Solutions business and for Trading & Banking Solutions, as partnering with Microsoft Cloud should - over time (but no earlier than 2025) - allow LSEG to deliver its broad data offering to clients in a faster and more reliable way than in the past.

Additionally, there is the hope that incorporating Microsoft Teams into Refinitiv’s Workstation may help compete against Bloomberg highly valuable IB messaging chat, which is one of the most entrenched applications amongst financial market participants.

As part of the agreement, LSEG committed to a minimum cloud-related spend of $2.8bn over 10 years. Whilst the partnership is certainly welcome and meaningful, it could also be interpreted as delayed maintenance capex, if we consider that major competitors transitioned to the cloud already years ago (e.g. Bloomberg, Factset).

Investment Solutions business - rated A - includes the legacy LSE index franchise (FTSE-Russell), an excellent business , that has been further complemented with Refinitiv’s smaller, yet strong, index presence in FX and fixed income (WM/Refinitiv benchmarks).

The indices industry is high quality, due to its consolidated nature, recurring subscription revenue business model and the exceptionally high switching cost.

Because asset managers and funds narrow their choice of benchmark to the most widely recognized index providers, the index market is an oligopoly and at times virtual monopoly in specific asset classes/geographies/themes. The FTSE-Russell equities franchise is the #3 player globally with c.20% share - competing against MSCI (25%) and S&P Dow Jones (25%) - with an offering skewed to equities, UK, and North America small caps.

Refinitiv’s index business is smaller, but enjoys a strong positioning in foreign exchange (through WM/Reuters Benchmarks) and fixed income (through Yield Book).

Given the industry secular growth tailwinds (driven by the shift to passive), the business should continue to grow at a healthy +HSD rate.

It is worth mentioning that some of the merger’s £400mn revenue synergies target will originate from new products at FTSE Russell based on Refinitiv’s data sourced from Enterprise Data Solutions, Tradeweb and FXall.

Third Party Risk - A-rated - is a small (c.5% group) solid business providing financial crime related intelligence data and digital identity verification.

It operates in a rapidly growing fragmented industry driven by increased financial and anti-money laundering regulation. It is estimated c.75% of the business revenues rely on recurring subscriptions.

Historically the business has grown at double digit rate organically and Refinitiv targets +8-10% going forward.

Wealth Solutions - C-rated - another small but poorly positioned business providing solutions for wealth management professionals (c.4% of group).

Similarly to the Trading & Banking Solutions business, Wealth Solutions has also been losing significant share over time. In 2022, Refinitiv estimated the business grew +3% versus a market growth rate of +5-7%; for context, market leader Factset grew over 2017-21 at double digit rate.

The revenues originating from subscriptions in this business are lower, at c.55%.

Experts’ interviews blame the business’ underperformance on, once again, underinvestment; considering its relatively small size in the context of the group, I don’t think any improvement will be material.

Moving on to the Capital Markets division, through the merger LSE’s legacy pan-European equities trading business was complemented with Refinitiv’s trading venues in fixed income - Tradeweb - and foreign exchange FXall and Matching business.

Tradeweb - rated A - is certainly amongst the best assets within the enlarged group. Tradeweb is a publicly listed fixed income trading venue, where LSEG has a c.52% stake (and 80% of voting rights) and is therefore fully consolidated; the business was originally acquired by Reuters in 2004, and listed by Blackstone following their acquisition of Refinitiv.

Tradeweb’s electronic platform for fixed income trading specializes in government bonds (or rates, c.80% of total revenues), although it is expanding also in corporate credit (20% of total).

It operates a single scalable trading open architecture technology who’s APIs can directly connect with customers existing trading and back office systems. According to Tegus experts’ interviews, this approach is stronger than competing venues such as Bloomberg, where its terminal based model does not offer the same level of integration and flexibility with customers’ internal systems.

The business is enjoying structural growth as the fixed income industry shift from phone-based trading (or Bloomberg IB chat) to fully electronic platform is still in its early phase (c.40% penetration), compared to more mature asset classes such as equities (virtually fully penetrated). This is due to the proliferation of types of bonds available from the same issuer, which historically made it difficult to find natural demand without an inventory-holding dealer.

Through its innovative technology, Tradeweb enables traders to find natural counterparties electronically and even trade portfolios of bonds at once. It thus grew very strongly in the last few years benefiting from network effects, where increased liquidity leads to better pricing, which in turn attracts new traders and so on.

Importantly, the trading data originating on Tradeweb is proprietary (ie. unique transaction data not replicable elsewhere) and thus amongst the most precious available dataset on the overall LSEG group platform. Merger revenue synergies are likely to be generated from sharing this data with other parts of the business (such as for example the formation of new indices and/or enterprise data feeds).

Having said this, few experts’ interviews highlighted that LSEG’s partial ownership of Tradeweb may make it difficult to prioritize further cooperation with other parts of the group to generate revenue synergies (this is an area that requires further investigation).

The main competitors are Bloomberg on rates, and MarketAxess on credit. In rates, Redburn estimates the company has 20% global market share, whereas in credit it holds 15%. Interestingly though, data from the European Commission merger review report covering European trading exclusively (not global), shows that Tradeweb controls c.45% of the European government bonds trading compared to c.25% for Bloomberg.

Tradeweb’s revenue model can be roughly split c.65% transaction/volumes based and c.35% generated from recurring fixed fees. Overall the economics of the business are excellent: in the last 5-years topline has grown organically in the mid-teens, EBITDA margins are >50% and rising, cash conversion is consistently above 100% and returns on capital averaged in the high-teens/low-twenties.

FXall and Matching business - rated B - are the two foreign exchange trading platforms inherited from Refinitiv; overall the foreign exchange franchise is a small but fair business, with some scope for improvement over time through integration with other parts of the LSEG portfolio, such as Workspace (to share FX trading data), Tradeweb (to hedge EM debt traded) and LCH Clearing (via ForexClear).

FXall is a well established dealer-to-customer platform, primarily focused on non-spot business; Matching is a smaller legacy dealer-to-dealer venue focused on more commoditized spot products, losing share.

FXall is strongly positioned in a relatively fragmented marketplace: the business offers a workflow product deeply embedded in over 200 dealers systems and used by 25,000 end users.

Its main competitor is Deutsche Börse’s 360T platform who has been gaining share via faster growth, which is the main reason why I give the business a B-rating.

Experts’ interviews suggest that over time, some revenue synergies could be extracted from integrating FXall with LCH’s clearing business ForexClear. However product innovation at LCH Clearing is somewhat hindered by LSEG’s lack of full control (owns c.83%), as minorities - who are mostly banks clearing members - want LCH to remain focused on existing services.

5. Competitive Advantages

The combined LSEG group enjoys a robust set of competitive advantages across its various businesses in the form of (i) scale, (ii) network effects, (iii) proprietary IP, (iv) entrenched distribution capabilities with high switching costs, and (v) brand reputation.

In its trading venues - spanning equities, FX, fixed income - the group scale drives network effects and a winner-take-all dynamic, in line with the known exchange industry dynamic that liquidity begets liquidity. Additionally, Tradeweb and FXall benefit from the continued electrification of trading in fixed income and foreign exchange instruments, which are less mature than equities.

Similarly, the Post-Trade business is a natural monopoly housing LCH Clearing, the largest clearing house for OTC swaps globally. This business benefits from (1) the regulatory drive to increase on-exchange clearing and (2) the stickiness of network effects and high switching costs, as evidenced by its controls of c.90% of all centrally cleared OTC interest-rate swaps globally.

The FTSE-Russell business, reported within Investment Solutions, is the 3rd largest index business by AUM globally, and benefits from the secular shift of assets towards passive strategies, proprietary IP and a leading brand/reputation.

The Refinitiv Enterprise Data business has a global footprint with leading sourcing and entrenched distribution capabilities. Switching costs are high in this business, as evidenced by the concentrated nature of the market (top-2 control c.70%) and Refinitiv’s leading market share (c.40%) as per the European Commission’s merger review document.

As previously outlined, the group’s weakest competitive positioning lies in its Trading & Banking Solutions business (and in the less relevant Wealth Solutions business), due to the shrinking market size, years of underinvestment and an inferior customer proposition relative to market leader Bloomberg.

6. Capital Allocation

Under Xavier Rolet’s stewardship (2008-17), capital allocation proved to be excellent: the strategic acquisitions of FTSE (2011), LCH Clearing (2013) and Russell Indexes (2014) all created very significant value for LSEG’s shareholders.

The same cannot be said of David Schwimmer. The Refinitiv transaction most likely destroyed value; this conclusion is further corroborated by the noticeable step down in the group transaction CFROI (which includes goodwill) shown in the chart below, driven by a decline in both asset turns and margins.

Furthermore, few months after digesting the Refinitiv merger, management returned over 2021-22 to acquire smaller assets to bolster specific parts of the group, such as:

In Trading and Banking Solutions, the acquisition of TORA aimed at fixing the order and execution platform.

In Enterprise Data Solutions, MayStreet brought an improved low-latency offering.

Third Party Risk Solutions was bolstered with the acquisition of Global Data Consortium’s high speed electronic ID verification.

What disappoints is the expensive prices that management has been willing to pay for these assets, at a median EV/Sales of 10x. Shareholders should advocate for greater price discipline to be applied on M&A.

I should also note that these bolt-ons acquisitions could be considered quasi-capex with more favourable accounting treatment. Indeed a cynic could argue that management is willing to pay these higher prices to fill the holes left by a decade of under-investments because, from an accounting standpoint, M&A amortization of PPA is usually ignored and taken below the EBITDA line. Overall it is fair to conclude that the new management team has yet to prove it can create value for shareholders through M&A.

More encouragingly, on the back of the disposal of BETA - an underperforming business within Wealth Solutions - at H1-2022 results, management announced the launch of a 12-month £750mn buyback to be completed by April 2024.

In addition, at the recent FY22 results the company requested shareholders’ approval to direct a further £750mn buyback from the Blackstone/Thomson Reuters consortium.

In the forecast period 2023-27, I model excess FCFE after the payment of the dividend to be deployed into buybacks. However, realistically, some of this spend will instead be used for acquisitions.

7. Management and Incentives Remuneration

Chairman of the Board – Don Roberts (65): appointed in May 2019. He spent 18 years of his career at Experian, first as group CEO (2005-2014) and then as Chairman of the Board (2014-19).

CEO – David Schwimmer (54): appointed in August 2018. Prior to LSEG, he spent 20 years at Goldman Sachs, in a variety of roles including Head of Market Structure, and Head of Metals & Mining.

CFO – Anna Manz (50): appointed in November 2020. Prior to that she was CFO of Johnson Matthey (2016-20) following 17 years at Diageo in a variety of senior finance roles including Chief Strategy Officer.

It is worth noting that most senior executives that operated under prior CEO Rolet left since Schwimmer’s appointment in 2018, including the CFO, CIO and COO that initially remained after Mr Rolet’s departure. The only exception I could find is Chief People Officer Tim Jones, who held his position throughout the tenure of both CEOs.

The current management team has big shoes to fill, given the impressive +25% p.a. rate at which the LSEG stock price compounded over Mr Rolet’s eight year tenure (vs MSCI World +15%).

Moving to remuneration practices, executives are poised to earn (i) an annual bonus and (ii) a long-term incentive pay award.

The annual bonus is determined based on operating profit growth (60% weight) and strategic deliverables (40% weight), with a high proportion of the set strategic objectives linked to ESG.

Strategic objectives for 2022 included (i) accelerating organic growth within and across divisions, (ii) improving group resiliency (e.g. by reducing net debt), (iii) delivering exceptional customer experience (e.g. measured by customers surveys) (iv) improve efficiency (e.g. via capturing cost synergies) and (iv) sustainability (e.g. publishing science based targets to be net zero by 2040).

The LTIP award is determined based on 3-year average adjusted EPS growth (60% weight) ranging between +6% and +11.5% CAGR and relative TSR growth (40% weight) ranging between median and upper quartile relative to the UK FTSE100 Index.

Noticeable additional items related to management remuneration are:

Bonus payments are to be paid 50% in cash but the remaining 50% is to be deferred into shares for a period of 3 years.

LTIP is to be paid out in Restricted Shares and an additional 2-year holding period post vesting applies to all executives.

Quantum of pay seems modest in relation to the company’s size and its US peer group: the maximum annual bonus for the CEO is c.225% annual salary and the maximum LTIP award is 300% of salary.

My sense is that this set of criteria should be meaningfully improved: for example TSR should be benchmarked against a set of global exchanges and market infrastructure peers instead of UK FTSE100 Index.

More importantly, I would prefer the LTIP to be linked to ROIC and FCFE/share growth, as these metrics are more suited for an acquisitive group to measure value creation/destruction.

8. ESG Considerations

In relation to environmental responsibilities, LSEG is impressively powering 100% of its operations through renewable energy, has a Net Zero target in place for 2040 and emissions per unit revenue have been declining over the last 3 years. Overall, LSEG is certainly a leader with regards to environmental matters.

From a social standpoint, the business has recently reached its diversity goal of 40% of women in leadership roles (by the end of 2022) and it expanded it to 40% of Group Directors roles covered by women by 2027.

In relation to governance, there’s two main areas for improvement:

Firstly the independence of the board should increase over time – currently 4 directors represent entities affiliated with the group (two from Blackstone, one from Thomson Reuters and one from Microsoft).

Secondly, remuneration practices could be improved by including a ROIC metric and changing the benchmark measuring relative TSR from UK FTSE100 to one including a more targeted and global peer group.

9. Overall Quality Assessment

LSE’s merger with Refinitiv led to the formation of a large global market infrastructure and financial data company with (i) nearly unparalleled financial data distribution capabilities and (ii) control of several dominant trading venues across multiple asset classes (FX, equities, fixed income, derivatives).

The combined LSEG group enjoys robust competitive advantages in the form of scale, network effects and high customer switching costs, proprietary IP, entrenched distribution capabilities and strong reputation and brand.

An in-depth analysis of the acquired assets shows the group has strong competitive positions in businesses with deep moats in Indices, Post-Trade, fixed income trading venue Tradeweb and Third Party Risk Solutions - accounting for c.45% of group revenues

Having said this, the addition of Refinitiv diluted the quality of the enlarged group, with the addition of several mediocre assets (Trading & Banking Solutions, ThomsonOne Wealth, FX Matching business) requiring reinvestments. This is evident in the proforma financials through an increase in capital intensity, and a decline in both margins and ROIC.

My own primary research and a series of experts’ interviews highlight several concerning issues in part of the acquired portfolio of assets, including multiple poorly integrated technological platforms, confused sales strategies and chronic price discounting, poor customer service and loss of market share.

Thus, the merger most likely destroyed value, earning a c.6% post tax ROIC and didn’t address legacy LSE lack of vertical integration in derivatives. The new management team that orchestrated the deal has yet to improve its capital allocation track record given recent expensive bolt-ons acquisitions. Shareholders should advocate for changes in the current management remuneration structure to increase M&A spend accountability.

Finally, there is an exogenous risk around LCH clearing post 2025: in a post-Brexit world, LCH derivative clearing in Europe relies on the EU’s willingness to extend equivalence, which is set to expire in 2025; the potential adverse impact of regulatory changes thereafter isn’t negligible.

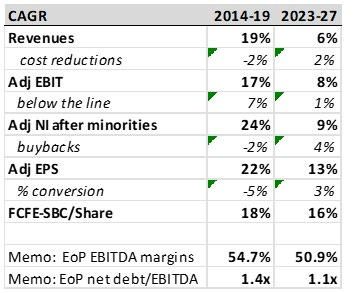

10. Financial Algorithm and Charts

My medium term forecasts incorporate EPS growth in the low-teens broken down as c.+6% from sales growth, c.+2% from cost synergies/operating leverage, c.+4% from buybacks.

Consensus does not appear to model FCFE correctly, as it likely fails to deduct minority leakages tied to Tradeweb and LCH Clearing, SBC and lease principal payments.

Importantly, I am more prudent than consensus on EBITDA margin progress because I do not extrapolate the CFO guidance for limited costs growth in 2023-24 further out in the future. This is to reflect the fact that the persistent reinvestments made since the merger will impact LSEG via more muted operating leverage.

LSEG is still clearly catching up with better invested competitors (e.g Bloomberg, Factset), as evidenced by (i) its higher capex/sales ratio, (ii) spend on expensive bolt-ons (at EV/sales 10x) to bolster existing product portfolio; (iii) the recently signed 10-year partnership with Microsoft to increase cloud spending (competitors moved to the cloud years ago).

As merger cost synergies will be exhausted by 2024, it is prudent to assume that cost growth will step-up in 2025-27 relative to 2022-2024; interestingly, ex-synergies, costs in 2022 already grew at +7%.

The charts below aim to summarize the embedded financial forecasts.

11. Valuation

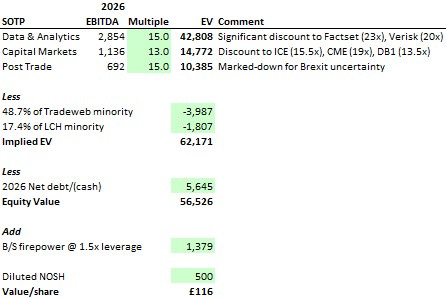

LSEG’s valuation discount to various peers is probably a reflection of: (i) its perception as a horizontal conglomerate with presence in different asset classes not vertically integrated and (ii) its slightly slower sales growth, profitability and cash conversion.

Looking at LSEG’s own historic multiples, I note that following the announcement of the transaction in Aug-2019 the stock and its multiple spiked. However subsequently the revised integration costs guidance announced at FY20 results in Mar-2021 brought the multiple back down in line with its historic median.

I calculate a 4-year IRR and price target using an exit P/FCFE of c. 20x (or c.5% FCF yield). The target multiple is in turn derived using the 10-year average P/E of 22.5x and applying a cash conversion of 90% (in line with the 2014-22 average).

For context, I note the implied target P/E of 22.5x is at a c.50% premium to the market (c.15x) and it compares to LSEG’s historic relative multiple, over 2014 through mid-2019 (ie. pre-deal announcement), of 1.40x.

I conclude the risk/reward is not yet sufficiently attractive to recommend starting a position at these levels.

I cross-checked my approach using a simple sum-of-the-parts, which yields a broadly similar conclusion for an estimated value per share in FY26 around c.£116.

Appendix - Areas for Further Work

LCH Clearing:

Investigate further potential scenarios in which EU does not extend clearing equivalence in 2025.

Dig into relationships with minorities who appear to be able to slow/delay product innovation.

Enterprise Data Solutions:

Dig further into Bloomberg bundling pricing and its recent discounts for data to large clients; evaluate potential countermeasures by Refinitiv.

Dig deeper into how much Microsoft Cloud partnership is about innovation versus investment catch-up.

Tradeweb:

Understand management end-strategy with this asset (only 52% owned).

Investigate corporate governance and potential cooperation.

Costs base:

How does spend on the Microsoft Cloud alter originally announced cloud spend investments.

Investigate further which areas of the cost base are seeing greater investments/savings/inflation.

Capital allocation:

Question management on recent bolt-ons premium prices.

Better understand what management defines as “business as usual” capex vs reported capex.

Definition of recurring/subscription revenues:

Investigate in more depth which products are truly recurring; ask the company to better define this (i.e. what is churn rate and new customer additions, how much price is taken p.a. etc).

Disclosures

I and/or others I advise may or may not hold a material investment in LSEG. Everything expressed here is only my own opinion, it should not be relied upon, nor should be considered investment advice. Always do your own independent research.

Nice work, I put both Deutsche Boerse and LSE in our team's portfolios back in 2012, we write similar cases like these. Both are great companies.

Very thorough. Good point on the LTIP peer group comparison and EPS growth for an acquisitive group ROIC would be a better measure. Many years ago Patrick Barton made a similar point about (Sir) Fred and Royal Bank of Scotland EPS growth incentives....we know how that ended!