Disclosures

I and/or others I advise hold a material investment in Ferguson. Everything expressed here is only my own opinion, it should not be relied upon, nor should be considered investment advice. Always do your own independent research.

Ferguson (FERG LN, FERG US) - Summary investment thesis

Ferguson is the largest specialist distributor of plumbing and HVAC supplies in North America; its dense local scale, global sourcing capabilities, best-in-class distribution and high-touch customer service levels allowed it to outgrow its markets and continuously gain share from a heavily fragmented competitive landscape.

The company has been transformed since the Great Financial Crisis: having exited all non-US subscale operations, today Ferguson is entirely focused on North America where it has leading scale and margins; in addition, the business is significantly less cyclical than in the past, having tilted the portfolio away from new construction end markets.

In the last 3-5-10 years the stock compounded at respectively 22%, 20% and 18%, well in excess of the global index.

Ferguson’s mid-term organic growth algorithm of +6-9% is highly attractive and underpinned by market growth above GDP (+3-5%) and share gains (+3-4%); the business requires little capital to grow (1.5% capex/sales), is fairly cash generative (c.90% cash conversion over last 5 years), and generates high returns on invested capital (CFROI over last 5-years of 13% and ROIC in the high teens); mid-term EPS should grow in the low teens.

The company prudent target leverage ratio (1-2x) leaves management with sufficient excess FCF to pursue a bolt on acquisition strategy, worth c.1-3% points of additional topline growth p.a., whilst funding the dividend (current yield of 2.5%) and opportunistic buybacks.

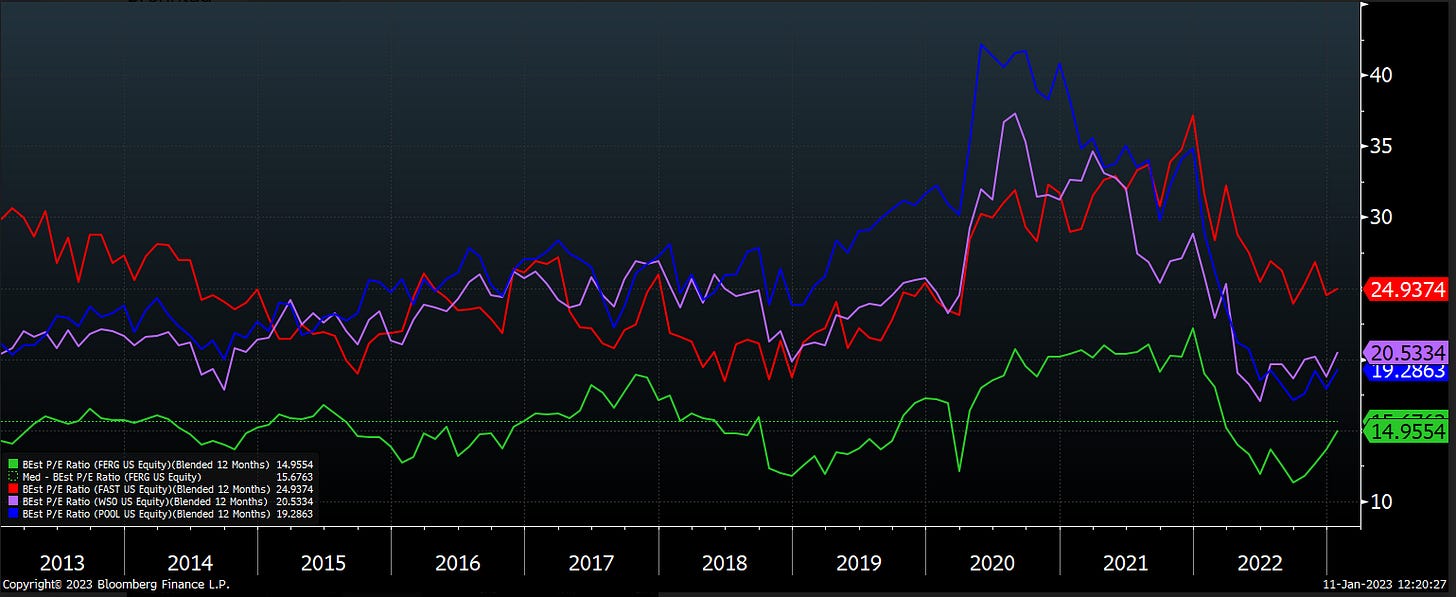

Excessive fears related to (i) the risk of over-earning during the pandemic and (ii) an imminent correction in US housing, offer the opportunity to purchase the stock on a 12-month forward P/E of 14x at a discount to the global index and lower than US listed peers (Fastenal, Watsco, and Pool Corp) which all trade at or in excess of 20x.

Company and industry context

Ferguson distributes over 250,000 SKUs to its circa 1mn+ professional contractor customers, through a network of 1,700 branches, 11 national DCs and a fleet of over 5,600 owned trucks, all fully integrated with a seamless omnichannel offering.

Following a near death experience during the Great Financial Crisis, management exited underperforming regions, focusing instead exclusively on North America where it benefits from scale advantages; furthermore, as of today, the more resilient Repair and Maintenance end markets account for 60% of group sales (only 30% in 2008) whereas exposure to more cyclical new construction fell to just 30% (from 60% in 2008).

The company has a balanced presence in US residential (55% group) and non-residential end markets (45%): the former benefits from structural tailwinds related to a decade of underbuilding following the US housing crisis of 2008/09 an strong new household formations; the latter is traditionally less cyclical and is poised to benefit from the Biden’s infrastructure bill.

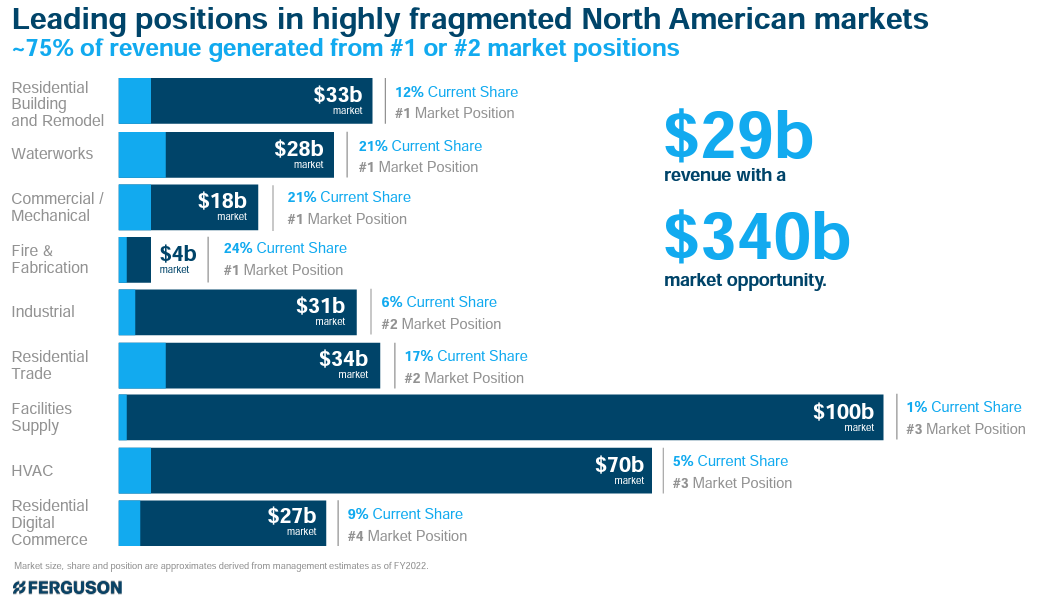

Ferguson operates in heavily fragmented markets, holding leading #1 or #2 position in 6 of the 9 verticals in which it operates (worth 75% of group revenues); the only verticals where Ferguson isn’t yet the number one player are HVAC (led by Watsco), Industrials (led by MRC), and Facilities Supply (led by HD Supply, recently acquired by Home Depot).

Importantly, all of Ferguson’s verticals leverage a common infrastructure which optimizes at group level sourcing, distribution and technological offerings; the company is thus channel agonistic, generating c.20% of revenues from its eCommerce platforms, c.10% of sales via its showrooms, and c.70% through its 1,600 branches located on average within 60 miles of 95% of the US population.

Business model

Ferguson’s competitive advantages are numerous and can be summarized as leading scale and technology and best customer service.

Ferguson serves a fragmented customer base of professional contractors that often source parts needed for a plumbing job on the day of service, therefore products supplied are generally a necessity and often need to be available on the day; as such, offering best-in-class service in the form of widest product offering and availability leads to share gains.

These in turn allow Ferguson to reinvest in the business via increasing the network density through opening new branches or acquiring competitors, further improving service levels and convenience for contractors. Eventually scale advantages lead to stronger power vis-a-vis suppliers, and improved purchasing terms are partially shared with customers (gross margins have been gently improving over time).

The level of customer intimacy is high in this business: the company’s 31,000 employees (or associates) have in-depth technical knowledge of both the various products and of their customer needs; frictionless transactions and customer service are of paramount importance for professional contractors, more so than price leadership.

In summary, Ferguson displays all the characteristics we would want in a leading distribution business: a customer base that values time and service over price, fragmented competition and suppliers base, dense local scale, best in class network of branches and DCs, and a tenured management team that fosters a culture of service to customers.

Management & Remuneration

The current management team has been involved in restructuring the business over the past decade, whilst upgrading the company infrastructure and digital offering.

CEO, Kevin Murphy, has been with the company for 21 years and took the role of CEO of North America in 2017 and group CEO in 2019; CFO, Bill Brundage, joined the company 18 years ago and was promoted to role of North America CFO in 2017 and group CFO in 2020.

Interestingly, the Chairman of the Board is the former CEO of Ashtead which he run for 12 years until 2019 and whose stock compounded TSR of 37% p.a. over the period.

Ferguson’s tenured management team fosters a strong culture, as evidenced by the company good score on Glassdoor ranking (3.8) relative to peers.

Whilst management incentives are broadly aligned with shareholders (based on TSR, EPS, Operating Cashflows), they appear overly complex and should ideally be simplified.

Financial algorithm

At last year’s Investor Day (Jan-22) management published a detailed financial framework for the mid-term: topline growth of +7-12% is split +6-9% organic and +1-3% from bolt-on acquisitions; the organic target can be further split into market growth of +3-5% and annual share gains worth +3-4% p.a, accelerating from historic gains of +2-3% p.a.

Over the last 5-years gross margins have been improving and are expected to continue to gently do so going forward; otherwise, there should be limited operating margin accretion due to the labor-intensive nature of the business; EPS should compound in the low-teens.

Capital intensity is low, with working capital around c.11-13% of sales and capex/sales of c.1.5%; cash conversion should average 80-90% of GAAP net income.

Capital allocation

The company targets a conservative net debt/EBITDA ratio of 1-2x, compared to the current level of 1x; excess FCF tends to fund bolt-on acquisitions and redistributed to shareholders via dividends and buybacks.

In the last 5 years Ferguson spent on average $400mn p.a. on M&A, acquiring 44 businesses, mostly of small size (average revenues of $50mn) paying between 7-10x EBITDA pre-synergies; the dividend payout is set around 40%.

Why the opportunity exists

Investors appear to be concerned about the risk of over-earning following an exceptional performance during FY21-22; I note however that (i) above trend growth was primarily (85%) driven by exceptional finished goods inflation which is sticky (ii) consensus already bakes in a decline in earnings in FY23, and (iii) gross margins, a key indicator of the health of a distribution business, have already normalized in the last 2 quarters.

Cyclicality is another key concern due to the exposure to the US construction cycle; nonetheless, the stock appears to already discount some of this risk at the current multiple (14-15x P/E); additionally, US housing should not collapse as it did during the Great Financial Crisis, given fewer excesses compared to 2006-07.

Until recently, the stock was listed only in the UK, despite generating 97% of its revenues in North America; the move of the primary listing on the NYSE (May-22) should fuel over time a rerating as American investors are likely to compare Ferguson to specialist distributors Fastenal, Pool, and Watsco, which trade on far higher multiples.

ESG considerations

The company appears to be taking its ESG responsibilities seriously, having recently adopted (i) the reporting framework set out by the Sustainability Accounting Standards Board, (ii) new carbon reduction targets for scope 1 and 2 emissions and (iii) reiterated commitment to transparency in ESG matters and disclose information in line with recommendation set out by the TCFD.

Environmental and Governance disclosures and initiatives appear strong; on Social matters the Board could do better, for example by improving diversity of the workforce.

Valuation

The stock trades on FY23 (July year-end) earnings of 14-15x.

The market is concerned that the company is over-earning. I suspect these fears are exaggerated considering (i) the recent inflation in finished goods is sticky and won’t revert back, (ii) management guided to 9.2% as the new base for operating margins and (iii) consensus is baking in a correction in FY23 earnings.

Assuming EPS in FY23 slightly contract after an exceptional FY21-22 and using a normalized exit P/E of 14x in FY26, I get to a mid-teens IRR, based on EPS CAGR over 2022-26 of c.10% and a dividend yield of nearly 3% growing over time.

If you enjoyed this write up, please do subscribe to my Substack for further investment ideas in the future.

Any feedback or comments is welcome!

Risks?

Good writeup otherwise

Thanx! Your post makes me think about AOJ (Denmark)? See Alex Eliasson on Twitter.